They may find themselves in need of currency exchange services in the bustling area of Raffles Place. This guide will help them navigate the various options available, ensuring they get the best rates and a seamless experience. He or she will learn how to compare rates, understand the fees involved, and identify reputable money changers, all while receiving friendly tips to make the process smoother. With this knowledge, they can confidently handle their currency exchange needs at Raffles Place.

Key Takeaways:

- Research the various money changers available in Raffles Place to ensure competitive exchange rates and lower service fees.

- Compare rates from different money changers, as prices can vary significantly. Use online platforms for real-time comparisons.

- Understand the impact of market fluctuations on exchange rates to make informed decisions on when to exchange currency.

- Enquire about additional fees or charges that may apply; always ask for the final amount you will receive.

- Use trusted services by checking customer reviews and ratings to ensure safe and reliable transactions.

Understanding Raffles Place Money Changer Services

As he commences on his journey through Raffles Place, it is necessary for him to understand the various offerings of money-changing services available in this bustling financial district. Money changers are establishments that facilitate the exchange of one currency for another, catering to both locals and tourists alike. They often provide competitive rates, enabling individuals to convert their money efficiently without excessive fees, making it a convenient option for those in need of cash for daily expenses or travel. These services play a crucial role in ensuring that currency exchange is accessible and straightforward for everyone.

What Are Money Changer Services?

An important aspect of travelling or conducting business in a foreign country involves navigating currency exchange. Money changer services provide her with the means to swap her home currency for the local denomination, generally at rates that can be more favourable than those offered by banks or airports. He may find various money-changing establishments in Raffles Place, each offering diverse rates and services that can impact his overall travel budget. By seeking out these services, she can ensure that she is getting the best value for her money and is able to manage her expenses effectively during her stay.

Why Choose Raffles Place for Currency Exchange?

An attractive trait of Raffles Place is its concentration of money changer services, making it a prime location for individuals looking to exchange currency. This area boasts numerous establishments, often competing for business, which can result in better rates and more favourable transactions for customers. Furthermore, many of these money changers operate in close proximity to transportation hubs and tourist attractions, providing convenience for those on the go.

What sets Raffles Place apart for currency exchange is the vibrant ecosystem of financial services that surrounds it. With the presence of several reputable money changers, he can easily compare rates and ensure that he is making informed decisions. Additionally, many establishments offer a variety of payment options, including card transactions, which adds to his convenience. Overall, the combination of competitive rates, accessibility, and a bustling atmosphere makes Raffles Place an ideal choice for anyone in need of currency exchange services.

How to Choose the Right Money Changer

The process of selecting a money changer in Raffles Place can be overwhelming, especially when one considers the multitude of options available. It is crucial for individuals to be meticulous in their choice to ensure they receive a fair exchange rate and reliable service.

Tips for Finding Reputable Services

You should look for money changers with a solid reputation. This often entails checking online reviews and asking for recommendations from friends or colleagues who have prior experience. Additionally, it’s a good idea to check whether local authorities have licensed and regulated the service.

- Read customer reviews and testimonials online.

- Ask for recommendations from trusted acquaintances.

- Verify that the money changer is licenced and adheres to regulations.

Recognising the signs of a reputable money changer can save one a significant amount of hassle and potential loss in the exchange process.

Factors Influencing Exchange Rates

You might be surprised to learn that exchange rates can fluctuate due to multiple factors. For instance, demand for a particular currency or geopolitical events may significantly impact the rates offered by money changers. Furthermore, understanding the historical context of a currency can also aid in predicting its exchange rate trends.

- The current economic climate and market conditions.

- Geopolitical events that may affect currency stability.

- Supply and demand for various currencies.

The interplay of these factors can result in varying rates from one money changer to another, making it crucial to stay informed.

Money changers often adjust their rates to reflect the market, meaning that individuals may encounter significant discrepancies in prices. To navigate this, consumers should continuously compare rates and timings so they can make well-informed decisions.

- The relationship between different currencies and their historical trading rates.

- Local and global economic news that might impact exchange rates.

- Time of day, as rates can change throughout the day.

Comparing Rates: How to Spot the Best Deals

Best practices for spotting the best money changer rates include using online tools, comparing rates from different services, and being aware of any hidden fees that might apply.

Comparison of Money Changer Rates

Rates can exhibit considerable variance between different money changers; therefore, conducting thorough comparisons will maximise the chances of obtaining a fair deal.

Rates not only define the immediate transaction but also contribute to the overall experience of exchanging currency. Consequently, individuals are encouraged to regularly check rates prior to making transactions to ensure they receive the best possible deal.

Additional Money Changer Rate Insights

| Additional Fees | Impact on Total Cost |

|---|---|

| Service Charge | Can increase overall costs. |

| Transaction Fees | May vary from one location to another. |

Navigating the Exchange Process

How to Approach a Money Changer

A few straightforward strategies can greatly improve your experience as a money changer. He should first take time to observe the setup of the money changer’s booth, noting any signs that display the currencies exchanged and their respective rates. They can approach the counter confidently, keeping in mind that employees are there to assist them and are often quite knowledgeable about the process. A friendly attitude goes a long way, and a simple greeting can lead to a smoother transaction.

Moreover, it’s wise for her to compare a few different money changers before finalising her decision. Many of the booths in Raffles Place may offer slightly different rates based on demand and competition. They can also ask for the best available rate, as some money changers may be willing to negotiate slightly, especially if they are aware that she has visited other booths.

Essential Documents Needed for Currency Exchange

Clearly, having the right documents on hand simplifies the currency exchange process. Most money changers will require a government-issued identification document, such as a passport, especially when exchanging larger sums. They should also have their local address ready, as some establishments may ask for this information as a precaution against money laundering regulations.

Additionally, it’s beneficial for him to have any receipts or proof of purchase for currency he is exchanging, should he be selling foreign notes. This can help to avoid any misunderstandings and expedite the process. Ensuring that these documents are prepared in advance can save valuable time and streamline the exchange experience.

The list of vital documents is not extensive, but being well-prepared undoubtedly makes the process smoother. It is always advisable for she to check in advance with the specific money changer to ensure they have all the necessary paperwork, as requirements can vary between different locations.

Understanding the Exchange Rate Display

What is needed for any successful transaction is a clear understanding of how exchange rates are displayed. He should pay attention to both the buying and selling rates posted by the money changer. The buying rate is what the money changer pays for foreign currency, while the selling rate is what they offer to customers. A good grasp of these rates will help her make informed decisions regarding her currency exchange.

It’s also important for them to be aware that the rates displayed may not include any additional fees that could apply. These might include service charges or commission fees, which can vary by currency. By asking questions and seeking clarification about the rates, they ensure they are fully informed before committing to any changes.

For instance, if she notices that the selling rate appears attractive but the buying rate is lower than average, she should further investigate whether there are hidden fees. This diligence can prevent surprises and ensure they receive the best possible deal.

Tips for a Smooth Currency Exchange Experience

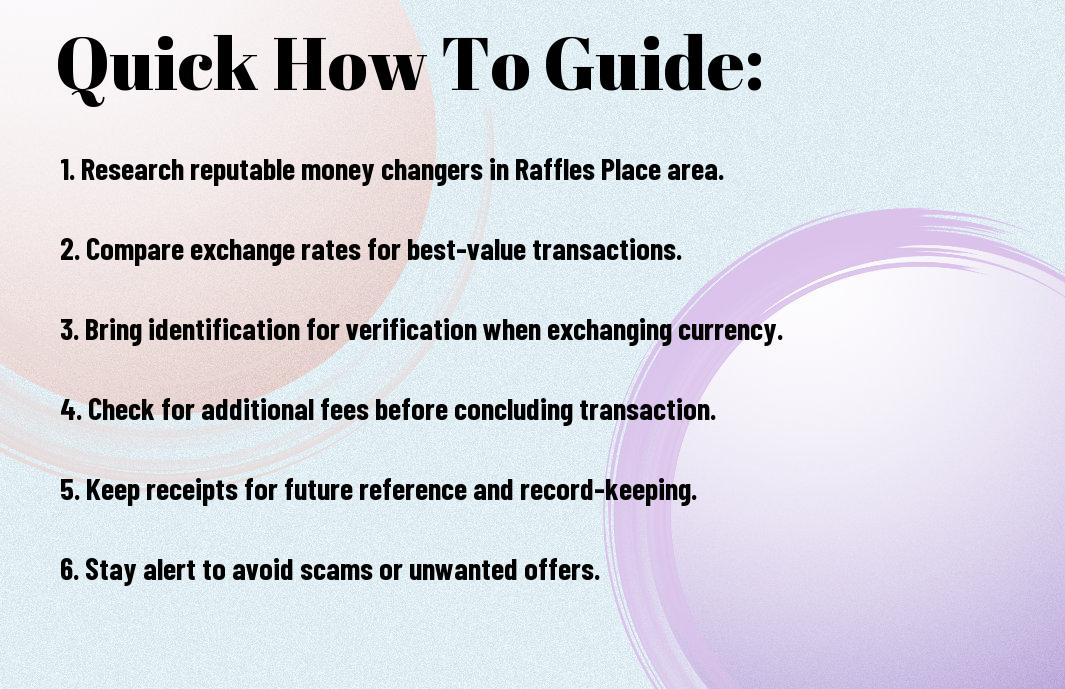

Many individuals seeking to exchange currency at Raffles Place can benefit from a few necessary tips to ensure a seamless experience. By preparing in advance, customers can navigate the complexities of currency exchange with ease. Here are a few key tips:

- Research the current exchange rates ahead of time.

- Know the operating hours of the money changers.

- Bring along appropriate identification if necessary.

- Be aware of any service fees that may apply.

- Try to exchange larger notes for better rates.

Recognising these simple strategies will significantly enhance their currency exchange experience.

Timing Your Exchange: Best Practices

Any traveller aware of the best times to exchange currency can potentially save a significant amount of money. Typically, weekdays are preferable for currency exchanges, as rates can fluctuate during weekends and public holidays. Additionally, it’s advisable to monitor rate trends and attempt exchanges during times when the rate is most favourable.

Moreover, being conscious of peak hours is beneficial. Early mornings or late afternoons tend to be busier, leading to longer wait times. If she or he can visit during quieter periods, the process will likely be much swifter and hassle-free. Staying informed ensures they will not miss out on the best rates available.

What to Avoid When Exchanging Money

On the other hand, there are several pitfalls one must avoid during the currency exchange process. Shunning money changers that appear unlicensed or have disreputable reviews can prevent unfortunate situations, such as receiving counterfeit notes. It’s crucial for customers to steer clear of individuals offering street exchanges, as these often lack transparency and security.

Furthermore, avoiding exchanges with hidden fees is critical. One should always clarify directions, service charges and any applicable commissions before agreeing to the exchange. This vigilance helps individuals ensure they are receiving the best deal possible.

When she or he feels pressured to exchange immediately, it is wise to take a step back. Those working in exchanges may encourage quick decisions, especially if rates appear to fluctuate rapidly. Avoiding rushed decisions allows him or her to make a more thoughtful choice about the amount they wish to exchange.

Handling Large Transactions Safely

Safely executing a large currency transaction is paramount to preventing issues that could arise from handling significant sums of money. It is advisable to inform the money changer beforehand if a substantial amount is to be exchanged, as this can ensure they have the necessary cash available. Additionally, choosing to visit during off-peak hours can also enhance safety, as one is less likely to attract undue attention in a quieter environment.

What’s more, individuals should consider using secure methods for transporting large amounts of cash. Discreet wallets or travel pouches can lessen the risk of theft while carrying cash. Taking the time to plan the transaction carefully is a strong measure of precaution that can lead to a more secure and confident exchange experience.

Exploring Alternative Currency Exchange Options

For those seeking to enhance their currency exchange experience beyond the bustling money changers of Raffles Place, alternative options do abound. By considering different avenues for currency exchange, currency travellers can potentially secure better rates, convenience, and peace of mind. Whether they choose online platforms or the conveniences of local stores, these alternatives can offer a refreshing change from traditional currency exchange methods.

Online Platforms: The Pros and Cons

For many, online currency exchange platforms represent a modern solution to an age-old need. However, like any service, these platforms have their own distinct advantages and disadvantages. Understanding these can help individuals make informed decisions that suit their circumstances.

| Pros | Cons |

|---|---|

| Convenient access from anywhere with an internet connection | Potential for higher fees from some platforms |

| Ability to compare multiple rates in real time | Security concerns with sharing personal information online |

| Often offer competitive exchange rates | waiting time for transactions to be processed may vary |

| User-friendly interfaces for seamless transactions | Limited customer support compared to physical locations |

| Frequent promotions and discounts are available | Not all currencies may be supported |

Convenience Stores vs. Traditional Money Changers

Currency exchange options also extend to convenience stores, which may be a more accessible choice for individuals passing through urban areas. While they offer a level of convenience, he or she should weigh it against the potential limitations when compared to traditional money changers. Convenience stores often have extended operating hours, making it easier for them to grab the currency they need without the hassle of standard banking hours. However, while they provide crucial services, their rates and availability might not always match those found at dedicated money changers.

A typical convenience store may not cater exclusively to currency exchange, meaning that staff may have limited expertise on the specific needs of currency travellers. Additionally, convenience stores might not stock a full range of foreign currencies, unlike traditional money changers, which could limit options. Therefore, when deciding between these alternatives, he or she should consider factors such as exchange rates, availability of services, and the overall experience they desire during their travels.

Keeping Your Finances Safe During the Exchange

Unlike many busy places, Raffles Place is home to various money changers that can facilitate currency exchanges. However, he or she must remain cautious while handling cash transactions to avoid potential scams or losses. Ensuring financial safety during the exchange process is paramount, particularly in a bustling financial district where distractions abound.

Best Practices for Carrying Cash

While navigating cash exchanges, it is prudent for individuals to remain aware of their surroundings. They should carry only the amount of cash necessary for the transaction, leaving the bulk of their finances securely stored. It can also be beneficial to use a money belt or an inner pocket to safeguard the cash, especially in crowded areas where pickpocketing might occur.

Moreover, they might consider using a combination of cash and digital payments, allowing for flexibility while minimising the risk of carrying large sums of money. When engaging with a money changer, he or she should only extract the cash needed for the immediate exchange, thus reducing the temptation for loss during the process.

Identifying Genuine Money Changer Locations

Keeping a keen eye out for genuine money changer locations is vital for ensuring safety and reliability. Individuals should look for established money changers that have clear signage, prices displayed prominently, and seem busy with customers, indicating trustworthiness and legitimacy.

This can often include checking online reviews or seeking recommendations from friends who have experienced Raffles Place’s money changers first-hand. It’s also wise to avoid changing money with street vendors or those who appear overly eager to attract customers, as these may be indicative of fraudulent activities. By remaining vigilant and informed, individuals can confidently navigate their currency exchanges.

Summing up

With these considerations in mind, he, she, or they can confidently navigate the intricacies of Raffles Place money changer services. By understanding the varying exchange rates, comparing service fees, and recognising the importance of customer service, they can make informed decisions that ultimately benefit their financial transactions. Furthermore, taking the time to research and perhaps even visit multiple locations can ensure they secure the most favourable rates and a seamless experience.

Ultimately, armed with knowledge and a clear understanding of their options, she, he, or they can not only save money but also enjoy a smoother exchange process. Whether one is a local or a visitor, mastering the nuances of currency exchange in Raffles Place can elevate their entire experience in Singapore, allowing them to focus more on the enjoyable aspects of their stay.

FAQ

Q: What should I consider before choosing a money changer in Raffles Place?

A: Before selecting a money changer in Raffles Place, consider factors such as the exchange rates they offer, any additional service fees, the safety of the location, and their operational hours. It is advisable to compare rates from several changers to ensure you get the best deal. Additionally, checking online reviews or ratings can provide insights into the reliability and trustworthiness of the service.

Q: Are the exchange rates at money changers in Raffles Place better than those at banks?

A: Typically, money changers in Raffles Place offer more competitive exchange rates compared to banks. However, this can vary, and it’s important to compare the rates at multiple locations. Keep in mind that some money changers may charge service fees that can offset the benefits of a seemingly better rate.

Q: How can I ensure the safety of my transaction at a money changer?

A: To ensure the safety of your transaction, use well-established and reputable money changers. Look for those that display their exchange rates clearly and have a professional setup. Avoid transactions in secluded or poorly lit areas and always count your money before leaving the counter. It’s advisable to conduct transactions during daylight hours for added security.

Q: Can I use credit or debit cards to exchange currency at money changers in Raffles Place?

A: Most money changers in Raffles Place typically deal in cash transactions, and not all provide services for card payments. If you wish to use a card, check in advance whether the specific money changer accepts cards, and be aware that additional fees may apply for card transactions. For the most favourable rates, it’s often best to withdraw cash using your card from an ATM.

Q: What types of currencies can I exchange at Raffles Place money changers?

Money changers in Raffles Place generally provide a wide range of foreign currencies, including major currencies like USD, EUR, GBP, and AUD. However, the availability of specific currencies may vary by location. It is advisable to enquire in advance about the currency you wish to exchange to avoid disappointment.