Most people think understanding HDB resale price trends is akin to deciphering the Da Vinci Code. Believe me, I’ve experienced significant confusion while attempting to navigate this complex maze! Throughout my personal HDB journey in Singapore, from questionable kitchen fixtures to proposals seemingly from distant relatives, I’ve gained valuable insights into the underlying factors that influence these prices. So buckle up as we examine my amusing escapades and the fascinating factors affecting the resale market!

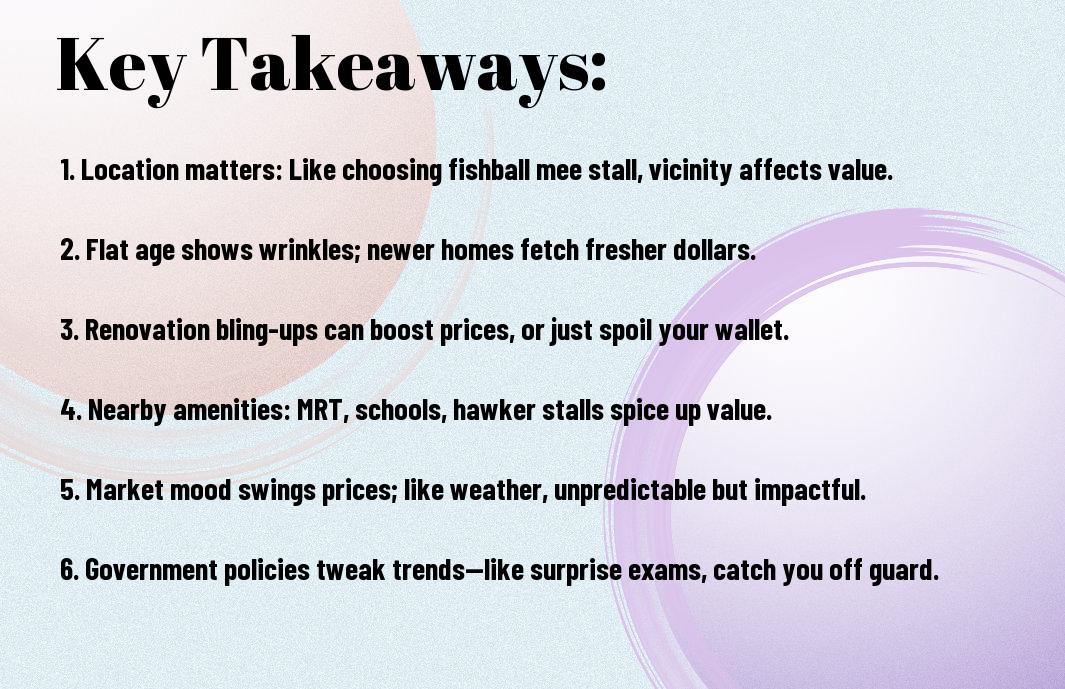

Key Takeaways:

- Location, Location, Location: Just like in dating, it’s all about location! I once thought I could score a flat near the MRT, only to realise it was a 30-minute sprint from the nearest stop. The closer you are to key amenities, the more your HDB resale value can soar – much like my heart rate after the sprint!

- Flat Size Matters: Apparently, size does matter when it comes to resale prices. I attempted to persuade my friends of the’minimalist chic’ appeal of my shoebox apartment, but they were uninterested. Bigger flats tend to fetch higher prices, so if your HDB comes with extra storage, your wallet will thank you later, unlike my friends after visiting my flat!

- Condition Counts: If your flat appears to have withstood a ‘Survivor’ episode, its resale price may suffer. I once saw a unit where the previous owners decided to paint every wall a different A small amount of maintenance can make a significant difference! hinking?’ Let’s just say it didn’t inspire a bidding war. Maintaining your property properly is crucial!

- Economics 101: Markets fluctuate, and so do HDB prices! During a market dip, I experienced a steep decline in my flat’s value. Monitoring economic trends such as job growth and interest rates can assist you in timing your sale effectively, or at the very least, prevent you from crying into your morning kopi.

- Government Policies: Just when you think you’ve got it all figured out, the government tosses in a new policy. I remember the introduction of a new cooling measure; my plans to cash out fizzled faster than a drink left out in the sun. Staying updated on policies can be the difference between a savvy sale and an ‘Oops, what was I thinking?’ situation.

The Basics of HDB Resale Prices

The world of HDB resale prices in Singapore can be quite unpredictable! These prices reflect the market value of Housing & Development Board flats that have already been lived in and are on the market for resale. If you ever thought of plunging into the property pool, understanding these prices is like reading the water temperature before you jump in!

Could you please explain what HDB resale prices are?

Resale prices refer to the amount sold for HDB flats that have had previous owners. Think of it as that vintage car you’ve always wanted! While it might have a dent or two, the charm and character add to its value. Similarly, HDB resale prices fluctuate based on several intriguing factors!

Factors Influencing HDB Resale Prices

Between the bustling streets of Singapore and the serene parks, various factors can influence HDB resale prices. The location, proximity to MRT stations, and overall condition of your flat significantly influence its potential market value. Let’s not forget the undeniable impact of demand and supply – a little tug-of-war, if you will!

- Location and accessibility

- Flat condition and renovations

- Market demand and trends

At any point, assessing these factors can feel like a game of chess. You must plan several steps ahead! Your flat’s value could increase because of new developments nearby or quite the opposite if the area turns into a construction site. Watching these trends can be quite entertaining— or a headache! Knowing these influences helps you make informed decisions when buying or selling your home.

- Previous transactions in the area

- Government policies affecting housing

- Economic conditions impacting buyer’s affordability

HDB Resale Price: The Role of Location

Some people may believe that all HDB flats are the same, but in terms of resale prices, location is crucial! I’ve seen friends score incredible deals just because they lived near a lively hawker centre or a vibrant park. Meanwhile, others in less desirable spots might find their HDB dreams drifting further away. Finding the right area can lead to significant savings.

Location is crucial.

Below all the hype, everyone knows that location is the kingpin of HDB resale prices. I recall a time when my colleague sold her flat near Orchard Road. The bidding war was so intense; you’d think it was a blockbuster film premiere. Being in the right postcode can turn your property into a valuable asset.

Hitching a Ride on MRT Development

The role of MRT stations in influencing resale prices can’t be overstated. When a new MRT line arrives in your neighbourhood, it’s like discovering a hidden treasure! Everyone desires to live close to public transportation, leading to a significant increase in the value of those properties. I remember the buzz when my favourite neighbourhood got a new MRT station. My friends were all thinking of moving there, as if they just learnt it was the town’s hottest club!

And with new developments, it’s truly remarkable how the proximity to an MRT station can boost your property’s value. A friend’s flat price nearly doubled overnight due to the introduction of a new line. Suddenly, their modest HDB was the talk of the town, with eager buyers clamouring like kids at a sweetshop. It’s like living next to a treasure map—the closer you are, the richer your experience (and bank account) can become!

HDB Resale Price: Economic Influences

Keep in mind that the economy is like a jigsaw puzzle with many pieces interlocking. When the economy is booming, people flock to buy HDB flats, pushing prices up like a soufflé in the oven. However, when the economy wobbles like a toddler learning to walk, those same prices might take a dive, as folks hesitate to make such a big financial leap. I’ve witnessed my friends frantically trying to sell their flats amidst a recession – a veritable drama in the real estate industry!

How the Economy Sways Prices

One cannot ignore how factors like employment rates and economic growth directly impact HDB resale prices. People feel confident about investing when the job market is booming, and this enthusiasm is reflected in the rising demand for resale flats. I vividly recall a period when my coffee shop was bustling with homebuyers deliberating their upcoming major investments, and I found myself yearning for some property advice as I savoured my cappuccino!

Interest Rates: Sneaky Little Influencers

Prices can often feel the squeeze from interest rates, which seem to change as unpredictably as the weather in Singapore! When interest rates are low, borrowing becomes effortless, facilitating the purchase of your dream flat. However, when rates climb, buyers often get a bit skittish, much like how I feel when I accidentally stumble upon a spider in my flat. Believe me, I’ve had moments where I stared at my interest rate notifications like they were the villain in a horror movie!

The economy has an important bearing on those sneaky little interest rates. When central banks decide to raise or lower rates, it’s as if they’re disrupting the market. I’ve witnessed friends expressing astonishment at how a mere 0.5 per cent fluctuation left them at the beginning of their property search. It’s all a bit of a balancing act, isn’t it? So, as you navigate the HDB market, keep your eye on those rates—they can be the difference between a sunny day and a stormy one!

Bizarre Market Trends

To put it mildly, the HDB resale market can throw up some utterly bizarre trends that leave you scratching your head. One moment, a flat could be selling for a small fortune, and the next, it’s practically being given away. It’s as if the buyers and sellers are engaged in a whimsical game of hopscotch, hopping from outrageous pricing to unexpectedly low offers—all while I sit here, popcorn in hand, pondering what on earth is going on!

Prices Going Up, Costs Going Down!

Across the bustling streets of Singapore, I often find myself utterly bewildered by the fluctuations in HDB prices. Just when I try to convince myself that it’s a buyer’s market, the price of a flat in Punggol increases more quickly than I can refresh my property app. I’ve learnt to either embrace the chaos or invest in a strong cup of coffee.

The Mystery of the $1 Resale

After witnessing the wild rollercoaster of HDB resale prices, I stumbled upon the fascinating enigma of the infamous $1 resale. Could you imagine someone choosing to sell their property for just a dollar? It’s enough to leave you stunned and your wallet trembling with perplexity!

For instance, I read about a baffling case where a seller, trying to transfer ownership to their child, listed their HDB at the astonishingly low price of $1. It was not a sale you’d expect in a vibrant market like Singapore! The transaction was unique as it involved the transfer of property ownership rather than money. I suppose when it comes to property, sometimes things are not as they seem—perhaps, in some cases, it’s just a dollar sign with a story behind it!

Personal Experiences

Not every price trend is straightforward when it comes to HDB resale prices. My journey has been filled with unexpected turns and moments of laughter. The moment I decided to plunge into the HDB market, I soon realised that understanding these trends was as tricky as deciphering a toddler’s drawing. But hey, it’s all part of the adventure, isn’t it?

The Time I Almost Became a Property Tycoon

Experiences shape us, and in my case, that meant almost becoming a property tycoon! I spotted a gem of an HDB flat; its potential was visible from a mile away – or so I thought. I dreamed of turning it into a profitable flip. I ended up simply browsing through the local property listings instead.

That One Awkward Viewing Experience

Experiences in the real estate world can sometimes have an unexpected twist. During one particularly memorable viewing, I accidentally walked in with a family watching a lively episode of their favourite soap opera. Talk about a showstopper! There I was, trying to admire the living room’s potential while half the cast of the show were shouting at each other. I could hardly focus.

Another peculiar moment was when I found myself stuck in a three-way conversation about property prices with the seller’s overly friendly cat. It seemed like the feline had more to say than I did as it wandered between me and its owner, clearly keen on monopolising the attention. The whole viewing turned into comical chaos as I tried to take mental notes while the cat plotted its next nap!

HDB Resale Price: Future Trends

All signs point to an exciting future for HDB resale prices. With evolving governmental policies and a growing demand for affordable housing, I can’t help but feel optimistic. It’s like watching the plot of a good novel unfold—who doesn’t enjoy a great ending?

What’s On the Horizon for HDB Prices?

Behind the scenes, there’s a flurry of activity that could spell changes for HDB prices. I am confident that the development of more sustainable urban living spaces in Singapore will attract new buyers eager to invest in these up-and-coming neighbourhoods. Who wouldn’t want to live in a place that feels as fresh as a morning stroll by the waterfront?

Tech and Real Estate: A Love Story

As technology advances at a rapid pace, the real estate market embraces its captivating partner. It’s akin to immersing oneself in a romantic comedy, where a magical encounter occurs. Not only are online platforms making it easier to buy and sell, but innovations like virtual tours are turning the way we house-hunt into a thrilling adventure.

Therefore, the allure of technology in real estate contributes to value in ways beyond my imagination. Imagine scrolling through potential homes in your pyjamas, sipping your favourite tea, and not even having to step outside! With this combination, I anticipate not only increased efficiency but also a delightful experience for all parties involved—a mutually beneficial situation for all house-hunters!

To wrap up

Presently, I reflect on my experience with HDB resale prices in Singapore, and it feels a bit like deciphering the Great British weather – completely unpredictable! I once sold my flat following the opening of a nearby local hawker centre, and the value surged faster than my cholesterol levels on a day of indulgence. You might think timing and location are everything, but honestly, it’s about the imminent upgrades. You never know when they might transform your sleepy estate into a bustling hub! Therefore, monitor these trends closely and optimise your investments, while also considering the potential impact of a few prayers!

FAQ

Q: What are the main factors influencing HDB resale prices in Singapore?

A: Several factors come into play when it comes to HDB resale prices. Prime areas typically command higher prices due to their prime location, a lesson I’ve learnt all too well after numerous mishaps on the MRT. Proximity to amenities, such as schools, hawker centres, and public transport, can make a flat more desirable. Additionally, market conditions like demand, changes in government policies, and economic factors also play their parts. I still laugh at my friend who believed that buying a flat near a hawker centre would guarantee good food; unfortunately, they did not consider the closing times of the hawker centre! Isn’t it true that you can’t put a price on a late-night craving?

Q: How do government policies affect HDB resale prices?

A: Government policies can significantly affect HDB resale prices. For instance, when the government eases restrictions on HDB resale, it’s akin to Black Friday shopping – everyone flocks to grab the best deals! I witnessed this phenomenon in 2017 when the government reduced the Minimum Occupation Period (MOP) for resale flats. I had a friend who sold their flat as soon as the policies changed, pricing it just right, and ended up travelling to Bali before I even finished deciding between a cup of bubble tea and a bedok mee! Policies on upgrading, new housing projects, and cooling measures also play pivotal roles, making it a constant rollercoaster ride for potential buyers and sellers.

Q: Are there seasonal trends to know when buying or selling HDB flats?

A: Absolutely! The HDB market appears to have its own seasons, much like my questionable attempts at gardening – some flourish, while others fall flat. Generally, the market experiences a surge during festive periods like the Chinese New Year, as families often desire a fresh start or a place to host celebrations. I once thought about selling my flat just before the festivities, but then I remembered my penchant for festive goodies; I’d be picking up zongzis instead of conducting viewings! Whether you’re buying or selling, timing is crucial and should align with your personal circumstances, including your fondness for dumplings!

Q: How does the property age impact resale prices?

A: The age of an HDB flat plays an important part in its resale value. Newer flats tend to fetch a premium because of their modern features and amenities, similar to how my aunties rave about the latest smartphone capabilities. Conversely, the value of older flats can vary significantly. My neighbour tried selling their apartment, which was quite vintage, and then bemoaned the lack of buyers, amusingly asserting that shag carpets were making a comeback! While some buyers might appreciate retro charm, others will likely want a place that doesn’t remind them of their childhood homes – complete with ancient wallpaper! So, whether you love the nostalgia or prefer modern amenities, choose wisely!

Q: Is it advisable to invest in HDB flats compared to private properties?

A: Investing in HDB flats can certainly be a wise decision, especially for those looking for affordability and stability in the long run. Firstly, the entry cost is usually lower than that of private properties. A friend of mine once likened purchasing an HDB to the thrill of unwrapping a packet of their preferred biscuits – it’s significantly more cost-effective! HDB flats also come with government support schemes for first-time buyers, which private property doesn’t usually have. However, it’s crucial to conduct thorough research. As tempting as it is, don’t jump on every flat simply because it’s available – not every biscuit is worth dunking in tea! So, take your time, evaluate your options, and enjoy the search!