You might be wondering how to navigate the somewhat puzzling world of Singapore’s Treasury Bills, specifically the 6-month T-bills. Well, I’ve had my share of bids, and let me tell you, it’s been an adventure—filled with moments of excitement and a dash of panic. From misplacing my bid submission to discovering that my idea of a winning strategy may have been slightly off (let’s just say I had to learn the hard way that ‘guessing’ isn’t a strategy!), I’ve gathered insights that I’d love to share with you all, sprinkled with a bit of my own humour!

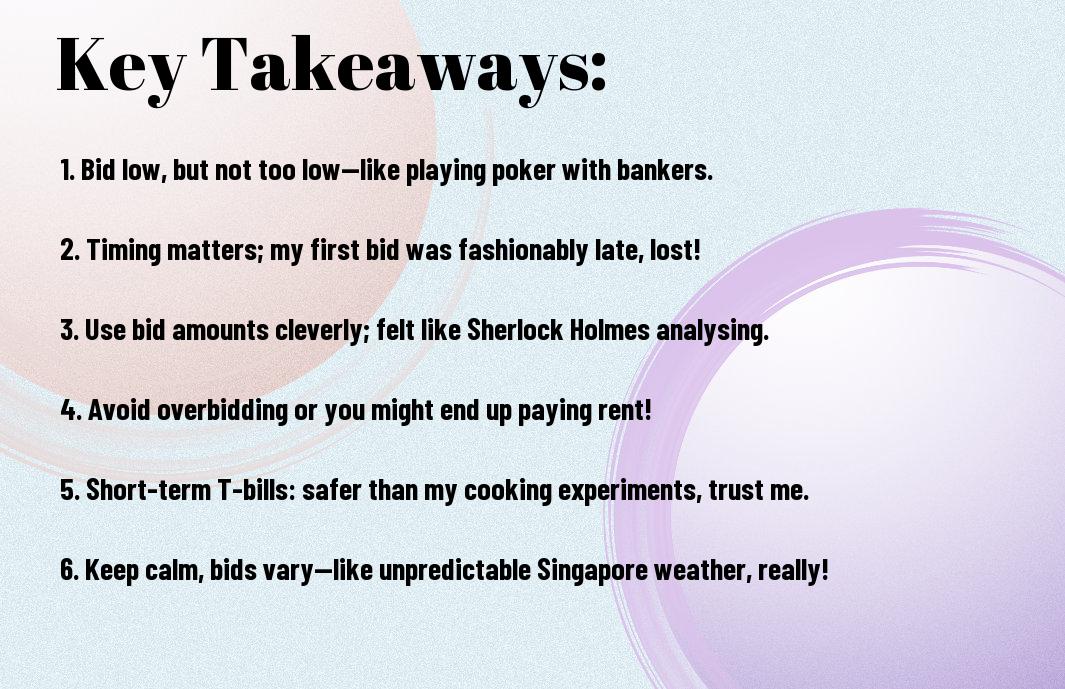

Key Takeaways:

- When bidding for T-bills, timing is everything! Much like trying to catch a bus in Singapore’s humidity—if you’re not there on time, you’re left sweating it out. I learnt this the hard way when I thought I could stroll in fashionably late, only to discover the best rates were already snatched up by eager beavers.

- Understand the difference between competitive and non-competitive bids. It’s like choosing between being the star of the show or the understudy. I once mixed these up and ended up as the understudy at a dinner party, eating the leftover bread rolls while others feasted on roast duck. Don’t let this happen with your T-bill bidding!

- Setting your bid amount is key. Going in too high is akin to overestimating your karaoke skills. Trust me, I’ve attempted “Bohemian Rhapsody” after one too many cocktails, and let’s just say my bid for a solo performance fell flat, much like my T-bill return that day.

- Use the right channels for bidding. Online platforms can be as confusing as navigating Singapore’s hawker centres without a guide. I once got lost trying to bid and ended up spending too long in line for laksa instead. Delicious, but not exactly a wise investment of my time!

- Last but not least, always keep a straight face. Whether you’re winning a bid or losing gracefully, showing your emotions is like revealing your poker hand—always a risky affair. I’ve breached this rule before, rolling my eyes when I lost a bid, only to have the auctioneer hold up my bid slip as a brutal reminder of my shattered dreams. Tip: don’t try to outsmart the seasoned bidders; just blend in and play nice!

What the Heck is a T-Bill Anyway?

A T-Bill, or Treasury Bill, is importantly the government’s version of a ‘I owe you’ note, but with more zeros and less chance of it getting lost down the back of the sofa. It’s a short-term security, typically lasting just six months, that provides a secure way to lend money to the government in exchange for a predictable return. Think of it as a low-risk investment that doesn’t require wearing a suit or attending boring meetings!

The Basics of T-Bills

Across the globe, T-bills are a popular choice for investors seeking safety over high returns. They are sold at a discount, meaning you pay less than their face value, and when they mature, you get the full value back. It’s like getting a fantastic deal at a jumble sale, where you walk away feeling like a champ for snagging a bargain!

Why You Should Care

Along my journey in investments, I’ve discovered that T-bills can be a fantastic option if you’re looking to preserve your capital without exposing yourself to the rollercoaster of stocks. They behave like a safety blanket on a chilly night, keeping your money snug and secure while you’re off pondering how to conquer the world (or just deciding what to have for dinner).

Therefore, T-bills can be an excellent introduction to the world of investments, particularly for those who may be hesitant to dive deep. With their predictable returns, you can rest easy knowing your money isn’t going to vanish into thin air like your last piece of cake at a party. Plus, they give you that warm, fuzzy feeling of supporting your country’s financial endeavors—without the need to wear a superhero cape!

My First Encounter with T Bill Singapore

Some might say my first foray into the world of T-bills was akin to a toddler’s first steps—awkward, wobbly, and a tad bit hilarious. I was sitting in front of my laptop, glasses perched precariously on my nose, trying to decode the mysterious charm of a 6-month Singapore Treasury Bill. Little did I know, a charming adventure awaited me in government securities!

The Nervous Beginner’s Investment

My heart pounded loudly across the room. What was I thinking, investing my hard-earned money into something as sophisticated-sounding as T-bills? With the confidence of a cat learning to swim, I navigated through the application process. Warning: the process was not visually appealing!

A Comedic Twist of Fate

First, I mistakenly applied for twice as many T-bills as I intended. When the confirmation email arrived, I nearly choked on my tea! There I was, thinking I was a savvy investor, only to discover I had inadvertently stepped into a financial comedy of errors.

Despite the seriousness of investment blunders, this one became a memorable and humorous tale. I was left wondering whether I’d just backed a winner or thrown my money into a bottomless pit. While friends advised diversifying, my new strategy was simply, “buy twice, laugh thrice”. And who knows? Perhaps my accidental investment would turn out as well as a comedic plot twist in a sitcom—unexpected but delightfully entertaining!

Strategies for Bidding on T-Bills

After venturing into the world of T-bills, I’ve realised that a good bidding strategy is crucial for success. My experiences have shown me that timing is everything—like trying to grab the last slice of pizza at a party! Assessing your risk tolerance and knowing when to make your move are crucial. You want to balance your bids like a tightrope walker rather than flinging yourself off the edge—though I must admit, I have wobbled a bit on that tightrope myself!

The Aggressive vs. Conservative Approach

Between the two approaches, my inclination leans towards the aggressive side—like that mate who insists on venturing into the deep end before checking if there’s water! Taking risks can lead to bigger rewards, but it’s also crucial to understand when to back off. Striking the balance is where the real fun (and sometimes disaster) lies!

Learning from My Mistakes

Against my better judgement, I once went all in with an aggressive bid and ended up regretting it. When the results rolled in, I realised I’d miscalculated my limits and ended up with a hefty lesson instead of a hefty profit. The thrill of excitement quickly turned into a classic sitcom moment, where I was left looking like a cartoon character who just slipped on a banana peel!

In fact, this experience taught me the importance of adjusting my strategies based on past blunders. I now keep a checklist of what works and what doesn’t—like a cook who learnt not to burn pancakes after a kitchen fiasco. This is all part of the learning process! The key is to play the long game and finesse your approach, which has turned my bidding experience from a tragic slapstick into a more calculated pursuit. Cheers to that!

Common Misconceptions About T-Bills

Your understanding of T-bills might need a little sprucing up. Many folks seem to think these short-term government securities are akin to popping your money into a fancy savings account. Spoiler alert: they aren’t just a marketing ploy for savings enthusiasts. In this blog post, I’ll unravel some head-scratching misconceptions I’ve come across in my financial journey, plus the good-natured laughs we can share along the way.

“Are They Just Fancy Savings Accounts?”

An amusing belief I stumbled upon is that T-bills are merely posh savings accounts. While they do offer a safe place for your funds, they work differently. Actually, their allure lies in the interest yield and the fact that the government backs them, making them less of a ‘fancy jar’ and more of a ‘trusty piggy bank’ that promises to grow your money while you twiddle your thumbs.

The Myths I Fell for (And You Shouldn’t)

Accounts couldn’t be further from it! I made the rookie mistake of thinking T-bills meant guaranteed profit without any risks. My first purchase was a leap into the unknown, armed only with Google searches and a few hastily read investment blogs. Spoiler: I didn’t have my million waiting for me by the end of the month!

To add humour, I thought T-bills were like a magic bean that would sprout into a beanstalk of riches overnight. The reality was more like tending a garden where not every seed I planted flourished. Who knew? I had to shake hands with maturity and realise that even government-backed securities had their quirks. So, take it from me, don’t get wooed by the fancy lingo; grab a cup of tea and dive headfirst into your research before plunging into the T-bill fray!

Real-Life Success Stories

Not every day do you stumble upon a treasure trove of success stories, especially in the world of T-bills. I recall a mate of mine, Tom, who decided to dip his toes into the 6-month Singapore Treasury Bill. With a bit of strategic planning and a sprinkle of luck, he managed to secure a tidy profit. It’s amazing how a little risk can lead to something surprisingly rewarding, much like my attempts at baking! Spoiler alert: my banana bread is still a work in progress.

When Luck Meets Strategy

Meets is the perfect description for the delightful encounter between a well-thought-out strategy and good fortune. I once crafted a plan based on market trends and, somewhat anxiously, submitted my bid. To my astonishment, the universe decided to play nice, and everything fell into place. That moment when the numbers aligned was akin to winning a game of Monopoly but without the chance of losing a sibling in the process!

The Unexpected Windfall

Unexpected is how I’d describe the sheer joy when my T-bill bid paid off beyond my wildest dreams. It stirred a mix of disbelief and excitement, much like when I found a forgotten tenner in my coat pocket. I remember dancing around my living room, thinking I could finally treat myself to that fancy dinner I’ve been eyeing. Talk about a win!

Luck certainly played a role in this adventure, as I was not expecting such a handsome return on my investment. It felt like winning the lottery, albeit in a more responsible and less flashy manner! I’ve since embraced the thrill of T-bill bidding, often sharing my newfound strategy with friends, who are now convinced I have an uncanny knack for luck. It’s really just a matter of good timing and a dash of savvy!

So, when I dipped my toes in the waters of the 6-month Singapore Treasury Bill, I must say, it was a bit like trying to figure out a complicated recipe while your cat is “helping”—amusing and slightly chaotic! My strategy involved some nerve-wracking bidding and a few cheeky cups of coffee to keep me alert. Ultimately, the experience taught me that a combination of patience and humour can enhance the enjoyment of the T-bill journey, even though my bank account didn’t fully appreciate the humour! Cheers to smart investing!

FAQ

Q: What exactly is a T-bill, and why is it important?

A: A T-bill, or Treasury Bill, is like a government-issued lottery ticket, but instead of dreaming about winning millions, you’re investing in something that’s as safe as your grandma’s sofa. Specifically, the 6-month Singapore T-bill is a short-term security that usually offers a decent interest return. Picture this: your money sits in the bank like a bored teenager, but with T-bills, it’s off on an adventurous six-month trip and brings back a little cash as a souvenir!

Q: How do I actually bid for these T-bills?

A: Bidding for T-bills is easier than trying to fold a fitted sheet – and we all know how that’s usually a losing battle! You can submit your bid through the Central Depository (CDP) or your bank. Just decide if you want to go competitive (like a kid at a sweet shop) or non-competitive (the savvier cousin who knows to just grab a bag). Fill in the details on the forms provided and submit them, hoping you come away with a ‘W’ and not just a consolation prize.

Q: What if I don’t get the T-bill? Is it like missing out on the last slice of pizza?

A: Absolutely! If that happens, it’s like seeing someone take the last slice of pizza you were about to grab. If your bid is unsuccessful, don’t fret; you can always try your luck next time. And remember, there’s always more pizza… or T-bills in this case!

Q: Is there any risk in investing in T-bills?

A: Investing in T-bills is like having a chat with a friend who’s always there for you – largely low-risk. But keep in mind there’s still a teeny tiny chance you might not get the interest you expected; imagine putting your heart into a karaoke performance and only getting crickets in response. However, considering the dependability of the Singaporean government, your chances of success are minimal.

Q: What’s the best strategy to ensure I bag a T-bill?

A: The best strategy is akin to spotting a bargain at a sale. It includes doing your homework, staying updated on T-bill announcements, and perhaps, just maybe, being a bit cheeky by placing a non-competitive bid for a lesser amount. This helps ensure you’re not just in the line for the crumbs. Treat it like your favourite game show; aim for that big prize without overextending yourself! Just be prepared for a bit of suspense, like waiting for the final verdict on your aunt’s infamous fruitcake!