Over time, students at the National University of Singapore (NUS) have unearthed some unsettling truths about financial aid that could leave them reeling. They might think they know the ins and outs of the system, but she soon discovers that hidden aspects can affect their financial journey. He or she will want to explore deeper into these eerie revelations that shed light on what it truly means to navigate financial aid at one of Asia’s leading universities. Join them as they explore the shocking realities that lie behind the scenes!

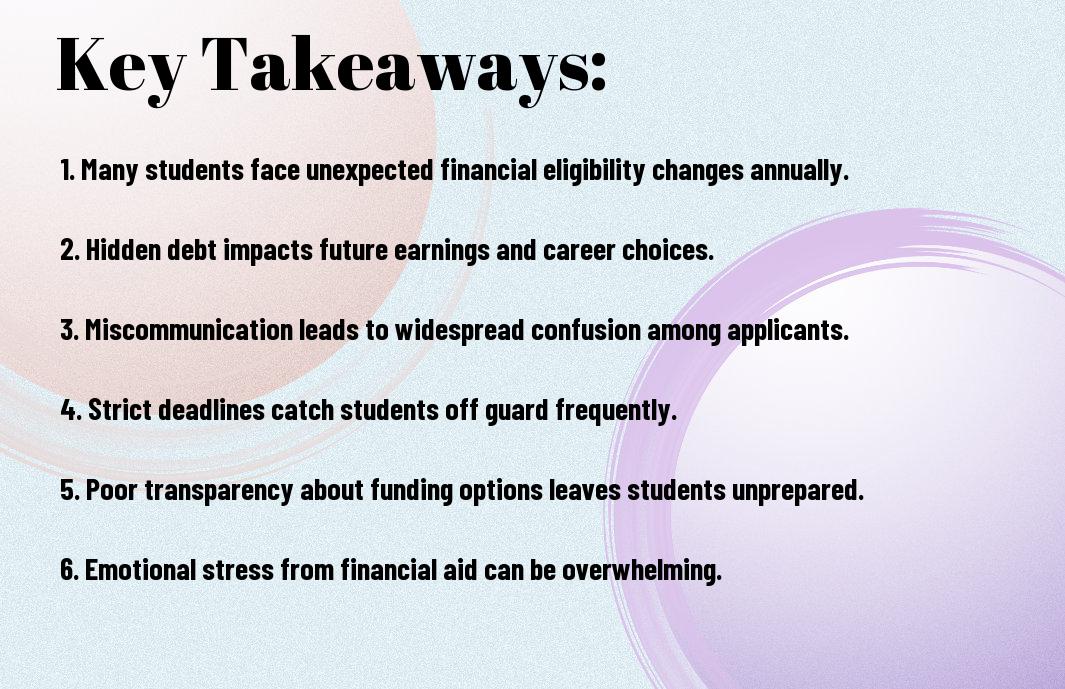

Key Takeaways:

- Hidden Criteria: Some financial aid assessments might use unconventional metrics that could disadvantage applicants without a clear explanation.

- Limited Availability: Financial aid is often not as widely available as students expect, leading to surprise shortfalls for many.

- Complex Application Processes: The application process can be overly complicated, deterring potential applicants from seeking assistance.

- Renewal Challenges: Applicants may face difficulties in renewing aid, creating uncertainty for students relying on continued support.

- Stigma Attached: There can be a social stigma associated with seeking financial aid, which may discourage students from applying.

Unveiling the Myths

Common Misconceptions about Financial Aid

On many occasions, he or she might believe that financial aid is only available to those from low-income families. This misconception often stems from the prevailing narrative that positions financial assistance as a safety net for the most disadvantaged. However, financial aid can actually be accessible to a diverse range of students, including those from middle-income backgrounds who may also struggle with funding their education. This broader scope means that financial aid is designed to assist a variety of students, irrespective of their economic background.

Additionally, they might think that applying for financial aid is an overly complicated process that involves extensive paperwork and endless waiting. While it is true that there are forms to fill out, many universities, including NUS, are working hard to streamline the application process, making it more user-friendly for students. This perception of a cumbersome application process can discourage students from even attempting to apply, potentially costing them valuable support.

The Reality Behind the Application Process

Behind every financial aid application lies a series of steps that can seem daunting at first glance. Many students aren’t aware that the application process often starts earlier than expected, with deadlines that can be easily overlooked. As such, he or she must ensure they stay vigilant to complete their application on time. Furthermore, it is important for them to gather all necessary documentation in advance, as this can significantly ease their experience when applying.

With financial aid offices often inundated with applications, it is imperative for students to present their cases clearly and concisely. This is why early preparation and understanding the required documentation can give she or he a considerable edge. The more organised they are, the higher their chances of securing the support they need.

Hidden Requirements You Didn’t Know About

An often overlooked aspect of financial aid are the hidden requirements that can catch students off guard. Many individuals may not realise that eligibility for certain financial aid programmes can hinge on criteria that go beyond simple financial need. For instance, some awards may require maintaining a specific academic standing or completing community service hours. These stipulations can create additional layers of complexity for those eager to secure their funding.

Moreover, they might not be aware that specific courses or areas of study can also affect their financial aid eligibility. Students pursuing less popular subjects may find themselves facing different expectations than their counterparts in more traditionally funded programmes. This lack of awareness can lead to unnecessary heartache and confusion during the financial aid journey.

Hidden within the fine print is often crucial information that can be the difference between receiving aid or not. Being proactive in understanding these requirements can empower them to navigate the financial aid landscape more effectively.

The Application Process

Assuming one is interested in applying for financial aid from the National University of Singapore (NUS), they will find that the application process can be somewhat daunting, yet it is crucial for securing much-needed assistance. The detailed and sometimes complex series of steps can be overwhelming for applicants, especially those who are new to the system. He or she will need to carefully prepare and navigate through various stages to ensure their application stands the best chance of success.

How to Navigate the Online Portal

With the financial aid application process primarily conducted through an online portal, applicants must become familiar with this digital interface. It is important for them to allocate enough time to go through every section, as missing out on any crucial information can lead to significant delays or even rejection of their application. They should also ensure that their internet connection is stable to avoid any frustrating interruptions while filling out forms or uploading documents.

With a good grasp of the portal, applicants can easily track their submission status, communicate with financial aid officers, and access helpful resources. They should also take advantage of any available tutorial videos or guides offered by the university to make their navigation more seamless. This tech-savvy approach is vital, particularly considering how central online resources are in today’s application processes.

Documents You Didn’t Realise You Needed

On launching upon the application journey, applicants might be surprised by the number and types of documents required. It is not just about submitting standard identification or academic records; there are several other forms and declarations that he or she may never have anticipated. Collecting these documents ahead of time is crucial, as it can prevent last-minute scrambles that could jeopardise their application.

On top of the usual academic transcripts and personal identification, they might need to submit proof of income, tax documents, and even certificates for additional qualifications or responsibilities, such as caregiving. It’s important for applicants to go through the list meticulously and double-check what is required, as overlooking a single document may cause unnecessary delays in processing their financial aid.

Process simplification can significantly aid applicants by breaking down the required documents into manageable steps. By listing and gathering all necessary paperwork well in advance, he or she creates a smoother application experience, allowing for more focus on the actual submission rather than on late-night runs to find elusive forms.

Timelines That Can Make or Break Your Aid

An understanding of the specific timelines involved in the financial aid application process is indispensable for prospective applicants. Deadlines for submissions can vary year by year and may be contingent on multiple factors, such as programme start dates or changes in policy. He or she must be diligent in noting these dates, as missing a timeline can mean the difference between receiving assistance or facing financial strain.

An equally significant aspect is the time taken for application processing, which can vary widely. Different types of aid may have different processing times, and being aware of this can help applicants plan their finances more effectively during their study period. It’s wise for them to continually check the university’s communication channels for updates regarding application status or any changes in timelines.

Your awareness of these timelines will empower applicants to take control of their financial futures. Staying organised and setting personal deadlines that align with those provided by NUS can reduce stress and make for a more successful experience overall, enabling them to focus on their studies rather than financial worries.

The Types of Financial Aid Available

Keep in mind that understanding the various types of financial aid available at NUS is imperative for students navigating their educational journey. Each type offers different benefits and requirements, and it can be overwhelming to sort through the options. Here’s a brief overview to help clarify matters:

| Types of Financial Aid | Description |

|---|---|

| Scholarships | Financial awards based on merit, talent, or specific criteria. |

| Grants | Funds that do not require repayment and are typically need-based. |

| Loans | Borrowed funds that must be repaid with interest. |

| Work-Study | Employment opportunities that allow students to earn money while studying. |

| Bursaries | Financial aids for students in need, often considering personal circumstances. |

Assume that each student carefully evaluates what they are eligible for and needs before applying. This can significantly ease their financial burdens during their academic tenure.

Scholarships: More Than Just Merit-Based

On the surface, scholarships are often perceived merely as financial aid for the brightest and most talented students. However, there is a wide variety of scholarships available that cater to different backgrounds, interests, and circumstances. Some scholarships consider factors such as community service, cultural background, or even chosen field of study, allowing a broader range of students to qualify for support.

Additionally, many students might be surprised to find niche scholarships for specific talents or hobbies, from dance to mathematics. This expands the possibility for those who might not traditionally shine in academia but exhibit extraordinary skills elsewhere, enabling them to ease their financial burden.

Grants: Free Money or Too Good to Be True?

Money for education can often feel like a fairy tale, especially when it comes to grants, which are often seen as free money. However, the catch is that grants are generally awarded based on financial need or specific criteria. Many students are left wondering if they’re really qualified and what it takes to secure these elusive funds.

Furthermore, students must file applications and provide necessary documentation to prove their eligibility, which can be a cumbersome process. The competition for limited grants can be intense, creating the illusion that free funding is unattainable for many. However, those determined to explore their options may find that grants can be a substantial financial aid source.

Plus, students should be aware that while grants don’t require repayment, they may have conditions tied to them, such as maintaining a certain GPA or following specific guidelines. This can add a layer of pressure to perform academically, which some students may overlook amidst the excitement of receiving potentially free money.

Loans: What You Need to Watch Out For

Financial aid can often come with strings attached, especially in the case of loans. They may appear as a straightforward option for funding one’s education, but students must watch out for the potential pitfalls that can accompany borrowing money. Interest rates, repayment plans, and the total amount owed can often become overwhelming for graduates, particularly if they enter the job market without a secure position.

Moreover, some students may be eager to accept loans without fully understanding the long-term impact. They might find themselves in a cycle of debt that can follow them well into their post-graduate life. It’s vital for students to make informed decisions about how much they need to borrow and to weigh the pros and cons before signing on the dotted line.

A wise approach is to explore all available options thoroughly and to consider not just the immediate financial relief but the future ramifications of taking on significant debt. Understanding loan terms and seeking financial advice can be invaluable in making sound financial choices.

The Impact of Income Assessment

For many students, understanding how financial aid is assessed can be a daunting task. It is crucial for them to grasp the complex calculations that ultimately affect their eligibility for assistance. The National University System (NUS) employs various formulas that take into account not only income but also family size and the number of family members attending college. This means that changes in personal or family financial circumstances can have unexpected consequences on the support available to them.

Understanding the Formula Behind Financial Aid

On a fundamental level, financial aid calculations consider the Expected Family Contribution (EFC), which provides a snapshot of what a family can reasonably contribute towards a student’s education based on their income and assets. They use specific income bands to determine how much aid a student might receive, making this formula pivotal in determining accessibility to financial support. Additionally, variations in income from year to year can influence the outcome; a sudden rise in earnings may significantly reduce a student’s financial aid package.

How Your Family’s Finances Can Affect Aid

Formula assessments take into account both parental income and assets, thus presenting a clearer picture of a family’s financial capacity. When examining aid packages, the NUS pays attention to annual income, including wages, bonuses, and any supplementary income sources. This creates a nuanced view of a family’s ability to contribute towards a student’s education, which ultimately plays a critical role in financial aid eligibility.

This impact can be particularly pronounced for families facing fluctuating income levels, as a single higher earning year may lead to a decrease in financial aid for the next academic period. Students may find themselves struggling to bridge the funding gap left by reduced aid, unaware of how their family’s changing financial landscape directly impacts their educational opportunities.

The Role of Assets in Determining Aid Eligibility

With the NUS’s focus on not just income but also family assets, it becomes even clearer how financial assessments are made. They evaluate a family’s savings, investments, and other significant assets to further understand what the family can afford to contribute towards a student’s education. This comprehensive approach helps to reflect the true financial picture of a household, ensuring that financial aid allocations are fair and equitable.

For instance, a family with substantial savings may find that their assets inhibit their eligibility for aid, despite having a lower annual income. This can lead to a perplexing situation where, on paper, they appear to have more financial resources than they actually do when considering their ongoing living expenses and obligations. It is crucial for students to be aware of how these assessments function, as they can significantly influence their educational journeys.

The Secrets of Award Disbursement

After receiving the exciting news of financial aid approval, many students might wonder about the actual disbursement of funds. They often find themselves asking, “When will I see the money?” The truth is, the timing of fund disbursement can be somewhat opaque, leaving students in a state of anticipation. Typically, disbursements occur at the beginning of each semester, but the exact timing can vary based on the university’s policies and the type of aid received. It’s crucial for students to check their university portal for specific dates, as failed disbursements or administrative delays can lead to unnecessary financial stress.

When Will You Actually See the Funds?

On occasion, students might experience delays in receiving their financial aid funds, which can lead to confusion. They should know that universities often disburse funds directly to their student accounts, which means the money might not appear in their bank accounts right away. Instead, it’s used to offset tuition, fees, and sometimes housing costs first. It’s advisable for students to prepare for these financial gaps by budgeting their expenses wisely, ensuring that they can cover necessary costs until the funds are released.

The Hidden Costs Not Covered by Aid

With many students enamoured by the thought of financial aid, they often overlook the hidden costs that can creep up unexpectedly. While financial aid can cover tuition and certain fees, it may not extend to vital expenses like textbooks, supplies, or transportation. This lack of coverage can leave students in a crunch, especially if they haven’t accounted for these important items in their financial planning. It is important for students to do thorough research on what their particular aid package includes and to seek resources that may help mitigate these costs.

For instance, the price of textbooks can be staggering, sometimes amounting to more than the cost of a single course. Students may also face additional fees related to specific programmes or activity costs that are not included in the overall aid package. By budgeting for these extras, students can help ensure they won’t find themselves in a difficult financial situation as the semester progresses.

Appeals: When Aid Isn’t Enough

Hidden challenges can arise for students when financial aid isn’t sufficient to cover their educational expenses. This is where the appeals process comes into play. If a student finds their aid package falls short, they are encouraged to reach out to their financial aid office to discuss their situation. Some universities allow appeals for additional funding, factoring in family circumstances, changes in financial status, or other relevant personal factors. Students should gather their documentation and prepare a compelling case for why they should be considered for increased assistance.

Disbursement processes can sometimes leave students wondering if they’ll need to take on additional debt in order to stay enrolled. By understanding the appeals process and its criteria, they can take proactive measures to secure the financial support that they need. It is recommended that students stay engaged with their financial aid advisors throughout their academic journey, fostering a partnership that can open doors to additional funding opportunities if required.

Real-Life Testimonials

Not every experience with NUS Financial Aid is a smooth-sailing journey. In financial support, students often find themselves navigating a labyrinth of paperwork and policies that can leave them feeling bewildered. She mentions that although she was initially optimistic about securing aid, the complex requirements often felt like an insurmountable hurdle, adding an additional layer of anxiety to her studies. He recalls a similar predicament, becoming exasperated by the seemingly arbitrary decisions that altered the trajectory of his education.

Student Experiences with NUS Financial Aid

With each interaction with the financial aid office, students have variable experiences that can significantly affect their academic careers. They often recount stories of long waits and unclear communication, leading to frustration and confusion. She reflects on a time when she was unsure if her application would be approved, delaying her ability to register for necessary courses and putting her educational path at risk.

The Emotional Toll of Financial Stress

One cannot underestimate the emotional burden that financial stress can place on students. He shares that sleepless nights became common as he worried about making ends meet while trying to focus on his studies. Feelings of isolation also creep in, as they can struggle to relate to peers who seem unaffected by similar financial woes, further compounding the stress they face.

Testimonials from those undergoing the financial aid process reveal a concerning pattern of mental strain experienced by students. Students find that the pressure of finances not only affects their academic performance but can also impact their overall well-being. In some cases, seeking help becomes an afterthought as students grapple with feelings of inadequacy and frustration, often stemming from the overwhelming need to secure financial support.

Success Stories: Navigating Aid Wisely

Stress often serves as a catalyst for students to rethink their approaches to financial aid. They discover that, by leveraging resources and seeking guidance, there are constructive paths ahead. She recounts how attending workshops on financial literacy transformed her understanding of budgeting and debt management, allowing her to take control of her finances, ultimately leading to success in her studies.

Financial literacy plays a significant role in shaping students’ experiences with aid. He explains that by learning how to navigate the system effectively, he managed to secure additional funds and make informed decisions regarding his educational investment. Their success stories serve as uplifting reminders that while financial aid can be fraught with challenges, informed navigation can lead to positive outcomes.

Final Thoughts on NUS Financial Aid

Now, as students prepare to navigate their financial aid journey, it’s necessary to keep certain aspects in mind to ensure a smooth application process.

What to Remember When Applying

The application process for NUS Financial Aid may seem daunting, but with the right approach, students can significantly improve their chances of success. They should pay attention to deadlines, as missed submissions could lead to lost opportunities. Additionally, they should ensure that all required documentation is submitted in full, as incomplete applications are often set aside.

The importance of maintaining clear communication with the financial aid office cannot be overstated. If students have any questions or concerns about their application, reaching out for clarification should be a priority. This not only helps them stay informed but also creates a rapport that could be beneficial during the review process.

Resources for Additional Support

Final-year students should make the most of the resources available to them, which can offer much-needed support during their financial aid journey. Institutions often provide workshops, informational sessions, and one-on-one consultations to assist students with their applications.

Recall that many online resources are also available, including blogs, forums, and videos dedicated to demystifying the financial aid process. These platforms can provide practical tips and insights, helping students feel more confident as they navigate their aid applications.

Tips for Making the Most of Your Aid

Final thoughts on optimising financial aid revolve around proactive management of the funds received. Students should carefully budget and track their expenses to avoid pitfalls that could hinder their academic journey. Setting clear financial goals can also provide direction and purpose for their spending decisions.

- They should keep receipts and records of expenses related to their studies.

- Students may consider seeking opportunities for part-time work that complement their study schedules.

- They must engage with peers or mentors who have successfully navigated the financial aid process for additional insights.

Recognising the importance of budgeting and tracking can make a significant difference in their financial well-being throughout their studies.

Support plays a crucial role in ensuring that students maximise their financial aid. By actively participating in workshops and seeking guidance from experienced peers, they can benefit immensely.

- Students should also explore additional scholarships or grants that complement their financial aid, as these can alleviate financial burdens.

- They might consider collaborating with fellow students to share resources or organise study sessions, which can lead to cost savings.

- Staying informed about changes in financial aid policies or new funding opportunities can also provide an edge.

Recognising the myriad of opportunities available can empower students to take charge of their financial situations, ensuring they get the most out of their educational experiences.

Final Words

To wrap up, the revelations surrounding the NUS financial aid might initially seem daunting, but they serve as crucial reminders for students navigating their educational journeys. He, she, and they must approach financial aid with a discerning eye, acknowledging that not everything is as straightforward as it appears. By understanding the complexities and potential pitfalls of financial aid processes, students can empower themselves to make informed decisions that will shape their academic futures.

Additionally, these revelations underscore the importance of transparency and communication between institutions and students. He, she, and they should feel encouraged to ask questions and seek clarification, ensuring that they fully comprehend their financial aid options. Ultimately, by staying informed and vigilant, students can turn these potentially unsettling truths into opportunities for growth and resilience as they pursue their academic dreams.

FAQ

Q: What are some common misconceptions about NUS financial aid?

A: Many students believe that financial aid at NUS is only for those in extreme financial need. However, financial aid packages are available for a range of income levels, and some are offered based on academic performance or specific circumstances, not solely on financial hardship. This can lead to students missing out on opportunities simply because they assume they won’t qualify.

Q: Are there hidden costs associated with NUS financial aid applications?

A: Yes, there can be hidden costs that students may not initially consider. For instance, some scholarships require students to attend workshops or submit additional documentation, which could incur travel or printing costs. Additionally, if a student fails to meet the criteria of their aid package, they may face penalties, which could affect their financial standing.

Q: How does NUS financial aid impact a student’s future financial opportunities?

Many students are unaware that accepting financial aid can influence future financial opportunities, such as eligibility for loans or other scholarships. In some cases, accepting certain types of aid might limit a student’s ability to apply for additional funding sources later, creating a potentially restrictive cycle of financial dependency.

Q: Can students lose their financial aid unexpectedly?

A: Unfortunately, yes. NUS financial aid can be revoked due to changes in a student’s circumstances, such as an increase in family income, failure to maintain satisfactory academic progress, or non-compliance with the terms of the aid. This unpredictability can leave students in a precarious financial position if they are not fully informed about the requirements.

Q: Is there adequate support for students struggling with financial aid processes at NUS?

A: While NUS offers several resources for students seeking financial aid, many students report feeling overwhelmed by the process. There can be a lack of personalised guidance, leading to confusion about eligibility, application procedures, and deadlines. Seeking advice from peers or academic advisors can often fill this gap, but the overarching support system needs improvement to ensure that all students can access the financial aid they need.