Many times, I’ve found myself lost amidst the bureaucratic maze of Revenue House, wondering if I should inhale deeply and venture in or just pop into a nearby café for solace. You know those times when you really need clarification on your property tax, but you end up in a hilariously long queue wondering if life’s too short for this? Well, join me on my amusing escapades through the official corridors, where you learn the do’s and don’ts of reaching out to these government offices without losing your sanity – or your coffee!

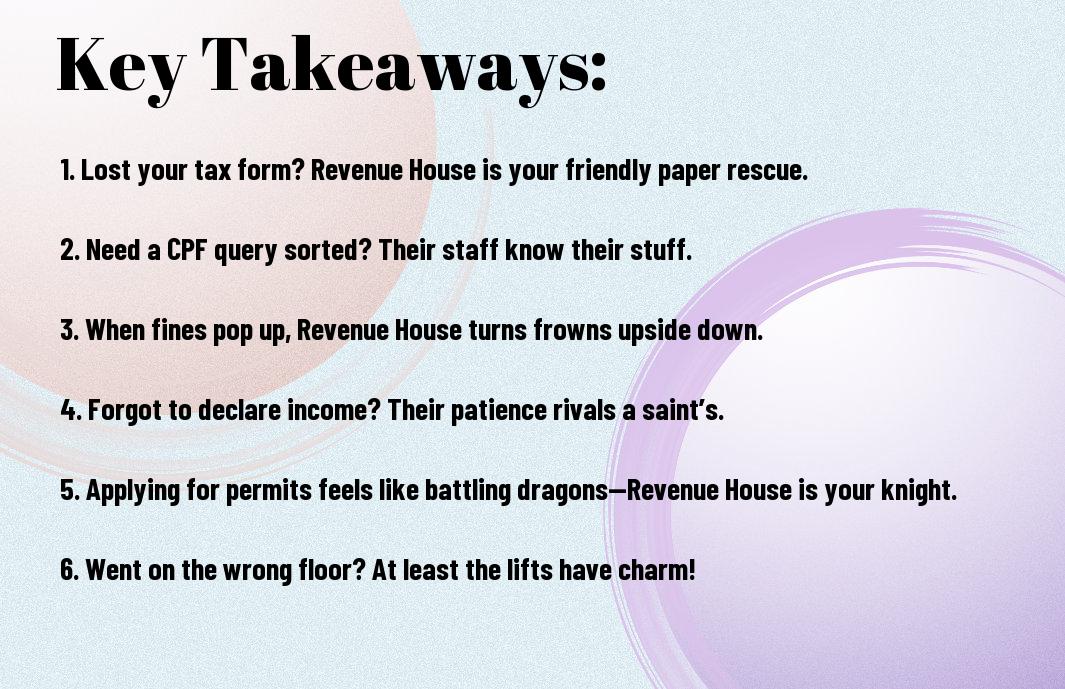

Key Takeaways:

- Understanding Your Tax Dilemmas: If you find yourself in a tax pickle, like attempting to declare a cat as a business expense (trust me, it won’t hold up), it might be time to pop into Revenue House for some guidance. The staff there can help clear any foggy tax-related confusion, although they may raise an eyebrow at your furry friend’s expense report.

- Registration is essential if you’ve recently started a new business venture. Failed to notify them about your little bakery selling cupcakes shaped like famous politicians? Revenue House can provide guidance on how to ensure your profits are legitimate.

- Business License Queries: Ever wondered whether you need a licence to sell your homemade jam? (Spoiler: You usually do!) The folks at Revenue House can help navigate the somewhat sticky situation of business licensing in Singapore, whilst probably enjoying a chuckle at your marmalade enthusiasm.

- Payment and Tax Relief Enquiries: If you’ve misplaced your tax paperwork during a weekend of DIY home improvements, or if you’ve made more than three trips to the local hardware store, Revenue House is the right place to seek assistance on tax relief and payment options. Revenue House has experienced a wide range of situations, including your ill-fated attempts at painting, which can certainly provide a humorous break!

- Updates on Policies: Tax laws aren’t set in stone, and if you hear about a policy change over your tea and biscuits, don’t hesitate to drop by Revenue House. They can explain the new rules, ensuring you’re not left in a comical state of confusion when your next tax returns roll around – a ‘which tax is this?’ moment is nothing to be laughed at! Well, not too much anyway.

Why You Might Need to Reach Out to Revenue House

A trip to Revenue House might just be on the cards when you find yourself tangled in tax confusion, needing clarification on property tax, or simply trying to decipher that cryptic letter addressed to you. Whether you’re running a business or just managing your personal finances, the friendly folks at Revenue House can steer you in the right direction, saving you from potential headaches or worse—drowning in a deluge of paperwork!

The Start of My Journey with Revenue House

An unexpected notification in the post was where my rendezvous with Revenue House began. I opened the envelope to see a tax bill that could easily rival my monthly grocery expenses! I knew right then and there that I’d need to enlist some expert help. A few frantic Google searches later, I braced myself to reach out for assistance.

The Confusion of Taxes and Why They Made Me Call

With my head spinning from all the financial jargon and letters flying around like confetti, I was no longer certain if I was supposed to pay or if I was the lucky winner of a tax rebate! The complexities of taxes are enough to make anyone’s head hurt.

Hence, I thought, why not call the nice people at Revenue House to decode the mystery? I rapidly realised that their cheerful accents and willingness to help were just what I needed. They patiently walked me through the ins and outs, ensuring I left the conversation with a clear understanding rather than a barrage of confusing terms that sounded more like ancient hieroglyphics than tax language!

Types of Issues You Can Contact Them About

Some issues that may entice you to reach out to Revenue House include:

| Tax Residency Status | If you can claim tax residence in Singapore. |

| Refund Requests | For when the taxman takes too much of your hard-earned cash. |

| Notice of Assessment Queries | When you’re scratching your head over that perplexing document. |

| Tax Relief Conditions | Understanding if you’re eligible for any lovely tax reductions. |

| Payment Issues | When technology decides to throw a tantrum during payment. |

You may find yourself in a complex situation, but don’t worry!

Tax Queries That Made Me Chuckle

That time I asked about claiming my pet hamster as a dependant, thinking I could reduce some taxes while also getting to keep my furry friend. To my disappointment, Revenue House does not consider hamsters as eligible dependents. If only they knew the emotional support provided by Mr Whiskers!

When Paperwork Goes Wrong: My Hilarious Dilemmas

To say I have had my share of paperwork mishaps would be an understatement! From mistyping my bank account number (goodbye, refund) to sending my tax return with a mysterious biscuit crumb embedded in it, let’s just say it hasn’t been a boring ride!

Goes without saying, the time I submitted an empty envelope thinking it contained my tax return was a highlight of my bureaucratic adventures. Watching the look on the officer’s face when they opened it was priceless! “I assure you, there was meant to be some very important paperwork in there,” I stammered, my cheeks burning. So, as you prepare your documents for Revenue House, double-check, triple-check, and maybe do a little dance to ward off the paperwork ghosts! You never know what mischief they might cause.

The Best Times to Reach Out

Unlike a bad haircut, some situations just can’t be fixed later. The best times to reach out to Revenue House are when you have a specific query or need assistance with your taxes or property issues. For me, realising that my ten-minute confusion over property tax saved me hours of stress was a lightbulb moment. Trust me, waiting for the last minute is like waiting for your bread to toast… only for it to burn instead!

Timing Is Everything: My Phone Call Chronicles

Phone calls to Revenue House can feel like a game of musical chairs, where you might end up standing alone at the end. I once called during a lunch hour, and let’s just say, it felt like chasing a bus that only runs every hour! My advice? Avoid peak times, because no one enjoys waiting on hold while listening to what can only be described as elevator music gone wrong!

When to Hold Off (Or Not) on That Call

When I first thought about calling Revenue House, I was convinced I’d need a life coach afterwards. But not every issue deserves a phone call right away. If you can clearly find your answers online, or if your question isn’t time-sensitive, it might be worth holding off. Instead, take a breather, sip a cup of tea, and revisit the subject after you’ve gathered your thoughts.

Timing can make all the difference. If I had called just to ask about a form I could find online, I would have felt quite daft! It’s helpful to sit tight and reflect on whether your query genuinely needs immediate attention or if you can dodge that call until the confusion settles. Trust me, a bit of patience may save you from the phone queue melodrama!

What to Expect When You Call

You might anticipate hearing the warm, melodic tones of a friendly operator when you dial the Revenue House number. Well, it’s a bit like waiting for a bus that may or may not arrive on time. You’ll be placed in a queue, typically the length of a Harry Potter series, while listening to some soothing instrumental music. But don’t fret; just keep your phone close, and in no time, someone will answer and be ready to address your queries!

Navigating the Phone Tree Like a Pro

After a few attempts, I discovered the phone tree is like a maze designed by a puzzle enthusiast—challenging yet fun! Be prepared to press buttons that seem to lead you in circles. However, once you get the hang of it, you’ll become a phone tree whisperer. I found it helpful to keep a pencil and paper handy, jotting down the options, and before long, I was dancing through the choices as if it were a waltz!

The Funniest Responses I’ve Received

During my calls to Revenue House, I cherished the unexpected responses that would tickle my humour. I once asked about tax clearance and got a response about how my cat might actually be an undercover agent trying to steal my biscuits. I was initially baffled, but I had to admit the mental image was quite amusing!

Consequently, I’ve collected a handful of these hilarious interactions like trophies—each one more surreal than the last. I once had an officer proclaim that they ‘couldn’t find my documents because they were busy swimming with the fishes’. Honestly, I’m still wondering why we can’t just blame bureaucratic delays on frisky fish! Each conversation brought a smile to my face, proving that even a simple call can lead to a delightful surprise amidst the mundane tasks of life.

Creatively Expressing Frustrations

Many of us have found ourselves in front of Revenue House, feeling a bit like a marooned sailor lost in a bureaucratic sea. Instead of throwing a fit, I discovered that expressing my frustrations with a dash of creativity could lighten the mood. Whether it’s doodling in my notebook or composing a cheeky limerick about the waiting time, humour has been my lifebuoy amidst the red tape. It’s amazing how laughter makes the tiresome process more bearable!

Personal Stories with a Twist of Humor

Above all, I cherish that time I accidentally stepped into the wrong queue at Revenue House, thinking I was waiting for a cup of coffee instead of a document renewal. As I stood there admiring the ‘invisible’ barista, the baffled expressions of fellow patrons made me realise I was in a land of forms, not frappuccinos. I chuckled, turned around, and made a swift exit, serving up a side of laughter to my own mix-up!

Comedic Takeaways from My Revenue House Adventures

Personal experiences at Revenue House often resemble a stand-up comedy routine. From the characters waiting in line—a gentleman practising his interpretive dance moves to pass the time—to the public service announcements blaring like they’re auditioning for a musical, you can’t help but chuckle. Those moments turned my frustration into amusement as I joined the ranks of the ‘waiting warriors’, hoping for paperwork privileges.

Frustration aside, I realised that the absurd situations I encountered often served as perfect comic fodder. An instance of amusement occurred when I mispronounced the officer’s name and inadvertently referred to him as “Reginald” during our conversation. That’s when I knew I was deep in the revenue wilderness! From quirky interactions to unintentional wordplay, you can always find humour lurking in the convoluted bureaucracy at Revenue House—you just have to look for it!

To wrap up

Hence, my adventures at Revenue House have taught me that reaching out can be as vital as finding that last biscuit in the tin! Whether it’s needing assistance with my tax filings or trying to decipher some confusing regulations, I’ve discovered that the staff are just a friendly call away. Once, I accidentally sent a form to the wrong department and was greeted with laughter rather than annoyance—thankfully, they love a good chuckle as much as I do! When you’re in doubt, don’t hesitate to drop by or pick up the phone; a smile might just be what you leave with.

FAQ

Q: When should I reach out to Revenue House?

A: The best time to reach out to Revenue House is when you have questions about your taxes, need assistance with tax filings, or require clarity on government policies. I once found myself utterly baffled by a tax form that looked more like a foreign language than anything else. I called them up, and after a hearty laugh, the friendly representative explained it to me. Their advice? ‘Treat it like a puzzle, just without the joy of seeing the finished picture.’ Oh, the fun we had!

Q: Can I visit Revenue House for help with my tax problems?

A: Absolutely! Pop into Revenue House if you’re in dire need of good old face-to-face interaction. I strolled in there once, feeling like I was about to appear on a game show titled ‘Guess That Tax Code’. The staff were surprisingly calming, and I walked out with answers—and a newfound appreciation for how taxing life can be!

Q: Is it better to call or visit Revenue House for a query?

A: That truly depends on your preference! When I had a particularly quirky question about tax deductions, I decided to visit. My friends teased me, saying I was making a ‘field trip’ out of it. I entered, and luckily, a nice coffee machine in the waiting area made the meeting more enjoyable! So if you’re feeling social, go for a visit; if you prefer your pyjamas, give them a ring!

Q: What documents should I prepare before reaching out to Revenue House?

A: It’s always wise to have your relevant documents ready—tax returns, identification, and any letters or notices you’ve received. The last time I reached out, I accidentally grabbed my grocery list instead of my tax documents; I ended up discussing why bananas were so overrated as a fruit snack! Avoid my mistake for a more productive conversation!

Q: How do I know if my issue needs immediate attention from Revenue House?

A: Act quickly if your issue involves imminent deadlines, such as tax filings, or penalties. I once received a notice that made me sweat so much, I thought I could fill a swimming pool. I hurriedly contacted them and was relieved to hear it was just a minor clerical error on their end. Always better safe than sorry—or as I like to say, better a phone call than a heart attack!