If you want to maximise your savings, UOB Personal Banking features offer you a plethora of opportunities to do just that. By taking advantage of high interest rates on savings accounts, cashback rewards on spending, and low-interest loans, you can ensure that your hard-earned money is working its hardest for you. With innovative digital tools and personalised financial advice at your fingertips, UOB makes it easier than ever for you to achieve your savings goals and secure your financial future.

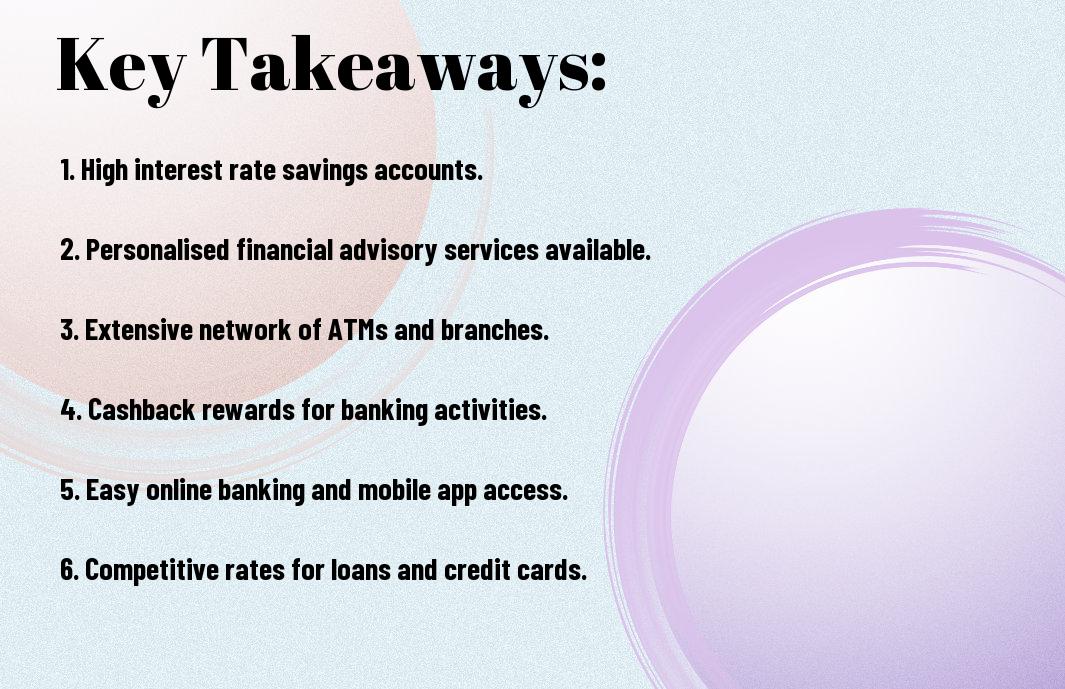

Key Takeaways:

- High Interest Savings: Utilise UOB’s personal banking features to maximise your savings with high interest rates on savings accounts.

- Flexible Savings Options: Take advantage of UOB’s flexible savings options, such as regular savings plans and fixed deposit accounts, to grow your wealth.

- Rewarding Bonus Schemes: Benefit from UOB’s bonus schemes and rewards programmes that can boost your savings over time.

- Convenient Digital Banking: Access UOB’s digital banking platforms to manage your savings efficiently and conveniently from anywhere.

- Expert Financial Advice: Seek guidance from UOB’s financial experts to make informed decisions and make the most of your savings potential.

Benefits of UOB Personal Banking

Convenience and Accessibility

While personal banking with UOB, you can enjoy the convenience and accessibility of a wide range of banking features tailored to suit your lifestyle. Whether you prefer managing your finances online, through the mobile app, or in person at a branch, UOB provides you with multiple channels to access and monitor your accounts effortlessly. With services like online account management, mobile banking, and a vast network of ATMs and branches, you have the flexibility to bank whenever and wherever it suits you best.

Personal banking with UOB also offers you the ease of making quick and secure transactions. With features like UOB Mighty Secure for mobile banking authentication and contactless payments with your UOB cards, you can conduct your financial activities with ease and peace of mind. Say goodbye to long queues and complicated processes. UOB prioritises your convenience by streamlining your banking experience, allowing you to focus on your savings goals without unnecessary hassle.

Moreover, UOB’s commitment to accessibility ensures that whether you are at home, at work, or travelling abroad, you can easily manage your finances without constraints. By providing a seamless digital banking experience and dedicated customer support, UOB empowers you to take charge of your financial well-being wherever you are. With UOB, convenience and accessibility are at the forefront of your personal banking experience.

Security and Reliability

Banking with UOB guarantees you not only convenience but also security and reliability in handling your finances. Robust security measures, such as encryption protocols and multi-factor authentication systems, are in place to protect your personal information and transactions. UOB takes the protection of your data seriously, ensuring that your financial details are kept confidential and secure from any potential threats.

Furthermore, UOB’s commitment to reliability means that you can trust in the bank’s long-standing reputation for stability and dependability. With a history of serving customers for decades, UOB has established itself as a trusted and reliable financial institution that prioritises the safety and satisfaction of its customers above all else. When you bank with UOB, you can have confidence in the security of your funds and the reliability of the services provided.

It is crucial to choose a bank that not only offers convenient features but also prioritises the security and reliability of your financial transactions. With UOB personal banking, you can rest assured that your money is in safe hands, allowing you to focus on maximising your savings and achieving your financial goals with confidence.

Maximising Savings with High-Interest Accounts

Some of the best ways to maximise your savings with UOB Personal Banking involve utilising their High-Interest Savings Account Features. These features are designed to help you grow your wealth efficiently and effectively. UOB offers competitive interest rates on their savings accounts, allowing you to earn more on your deposits compared to traditional accounts. By taking advantage of these high-interest accounts, you can watch your savings grow steadily over time.

UOB High-Interest Savings Account Features

Savings are a key tool for financial growth, and with UOB’s High-Interest Savings Account Features, you can take your savings to the next level. These accounts offer attractive interest rates that help your money work harder for you. Additionally, UOB provides convenient online banking services, making it easy for you to manage and track your savings anytime, anywhere. With features such as regular interest payments and no monthly fees, UOB High-Interest Savings Accounts are a smart choice to maximise your savings potential.

Tips for Optimising Interest Earnings

Optimising your interest earnings involves strategic planning and smart financial decisions. One tip is to regularly review and compare interest rates offered by different banks to ensure you are getting the best deal. By setting up automatic transfers to your high-interest savings account, you can save consistently and maximise your interest earnings over time. Another useful tip is to consider locking in your savings for a fixed period to take advantage of higher interest rates. By diversifying your savings across different accounts and investment options, you can further increase your potential for earnings.

- Regularly review and compare interest rates

- Set up automatic transfers to high-interest accounts

- Diversify savings across different accounts and investments

The key to optimising your savings with UOB Personal Banking lies in taking full advantage of their High-Interest Savings Account Features and implementing smart strategies to maximise your interest earnings. By following these tips and making informed financial decisions, you can watch your savings grow significantly over time. Perceiving the potential of high-interest accounts and utilising them effectively is imperative for maximising your wealth accumulation and achieving your financial goals.

Effective Budgeting with UOB Tools

To maximise your savings effectively, it is crucial to utilise the budgeting apps and software provided by UOB. These tools can help you keep track of your expenses, set budget limits for different categories, and monitor your financial health in real-time. By using UOB’s budgeting apps, you can easily identify areas where you are overspending and make necessary adjustments to stay within your budget.

Budgeting Apps and Software

To stay on top of your finances, UOB offers innovative budgeting apps and software that allow you to categorise your expenses, set savings goals, and receive notifications when you exceed your budget limits. These tools provide a comprehensive overview of your financial habits, making it easier for you to make informed decisions about your spending. With UOB’s budgeting apps, you can take control of your finances and work towards achieving your savings targets.

With UOB’s user-friendly budgeting apps and software, you can simplify the process of managing your finances and ensure that you are making progress towards your savings goals. By leveraging these tools, you can develop healthier spending habits, track your financial progress, and ultimately boost your savings significantly.

Setting Financial Goals and Tracking Progress

Goals: To help you achieve your financial aspirations, UOB enables you to set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals and track your progress effectively. By setting clear objectives and monitoring your advancement, you can stay motivated and focused on achieving your savings targets. UOB‘s goal-setting features allow you to visualise your progress and adjust your financial strategies accordingly, ensuring that you are on the right path to financial success.

Streamlining Expenses with UOB Cards

Once again, when it comes to maximising your savings, UOB personal banking features prove to be a game-changer. Let’s investigate into how you can streamline your expenses with UOB cards through their Cashback and Rewards Programmes.

Cashback and Rewards Programme

On top of providing you with a convenient payment method, UOB cards also offer attractive cashback and rewards programmes. By using your UOB card for everyday expenses such as groceries, dining out, or online shopping, you can earn cashback or accumulate reward points that can be redeemed for various perks. This means that every time you swipe your UOB card, you are not just spending money but also earning back something in return, making your expenses work for you.

Moreover, UOB often partners with various merchants to offer exclusive discounts and promotions for cardholders. This means that by simply using your UOB card at these partner outlets, you can enjoy additional savings or benefits, further stretching your pound. By taking advantage of these cashback, rewards, and exclusive promotions, you are actively reducing your expenses and getting more value out of every purchase you make.

Minimizing Fees and Charges

On the other hand, UOB cards also excel in Minimizing Fees and Charges, helping you avoid unnecessary costs. With features like no annual fees for the first year and waived annual fees for subsequent years with minimum spending, you can save significantly on card maintenance expenses. Additionally, UOB provides options for interest-free instalment plans, allowing you to spread out larger payments without incurring high interest rates.

For instance, by opting for UOB’s installment plans, you can purchase big-ticket items or manage unexpected expenses without worrying about accumulating substantial interest charges. When you minimise fees and charges associated with your card usage, you have more control over your finances and can make strategic decisions to save more in the long run. By leveraging UOB’s fee-minimising features, you are actively working towards a more financially secure future.

Investing Wisely with UOB Investment Options

After setting up your personal banking features with UOB, you may want to consider investing your savings wisely. UOB offers a range of investment products to help you grow your wealth. Let’s explore the types of investment products you can consider:

Types of Investment Products Offered

The investment products offered by UOB include Unit Trusts, Bonds, Structured Deposits, Stocks, and Exchange-Traded Funds (ETFs). Each of these investment options has its own characteristics and potential returns. It’s important to understand the risks and rewards associated with each before making a decision. This table highlights the key features of each type of investment product:

| Investment Product | Description |

| Unit Trusts | Professionally managed funds that pool money from multiple investors to invest in a diversified portfolio of assets. |

| Bonds | Fixed income securities issued by governments or corporations, providing regular interest payments over a fixed period. |

| Structured Deposits | Combination products that offer returns linked to the performance of an underlying asset, with a minimum guaranteed payout. |

| Stocks | Ownership shares in a company, giving investors the opportunity to participate in the company’s growth and profit through capital appreciation and dividends. |

| Exchange-Traded Funds (ETFs) | Basket of securities that trade on an exchange like a stock, offering diversification across multiple assets with lower costs. |

This comprehensive overview can help you make informed decisions when it comes to investing your savings. Recall, it’s crucial to assess your risk tolerance and investment goals before choosing the right investment product for you.

Risk Management and Diversification Strategies

Investment risk management involves strategies to minimise potential losses and protect your capital. Diversification is key to spreading risk across different assets and asset classes. By investing in a mix of investment products with varying levels of risk, you can reduce the impact of any single investment’s poor performance on your overall portfolio.

To effectively manage risk and diversify your investment portfolio, consider allocating your funds across different asset classes such as equities, fixed income, and alternative investments. Additionally, you can explore investing in different geographical regions to further diversify your portfolio. Regularly reviewing and rebalancing your portfolio is vital to ensure it remains aligned with your investment objectives. This proactive approach can help you navigate market volatility and achieve long-term investment success.

Protecting Your Finances with UOB Insurance

For UOB customers, safeguarding your finances through insurance is crucial in today’s uncertain times. UOB provides a range of insurance products to give you peace of mind and financial security. Whether you are looking to protect your loved ones, assets, or health, UOB has tailored solutions to meet your individual needs and preferences.

Types of Insurance Coverage Available

Protecting your finances with UOB insurance involves understanding the different types of coverage offered. Some key insurance products available to you include life insurance, medical insurance, home insurance, car insurance and travel insurance. These options give you the flexibility to choose the most suitable coverage based on your priorities and circumstances. Any decision you make should align with your financial goals and risk tolerance.

| Life Insurance | Provides financial protection to your loved ones in the event of your death. Offers peace of mind and ensures their financial stability. |

| Medical Insurance | Covers medical expenses in case of illness or injury, reducing the financial burden on you and your family. |

| Home Insurance | Protects your property and belongings against risks such as fire, theft, or natural disasters. |

| Car Insurance | Offers financial protection against accidents, theft, or damage to your vehicle. |

| Travel Insurance | Provides coverage for unexpected events during your travels, such as trip cancellations, medical emergencies, or lost luggage. |

Importance of Insurance in Financial Planning

One critical aspect of financial planning is integrating insurance to mitigate potential risks and protect your financial well-being. Insurance acts as a safety net, ensuring that you and your loved ones are financially secure in times of crisis. Including insurance in your financial strategy allows you to manage unforeseen expenses and protect your assets against unexpected events.

To maximise your savings and secure your financial future, it is necessary to incorporate insurance into your overall financial plan. By assessing your insurance needs and choosing the right coverage options, you can shield yourself from the financial impacts of potential risks. Note, having adequate insurance coverage is a key component of a comprehensive financial strategy.

Managing Debt with UOB Debt Consolidation

To make the most of your savings and effectively manage your debt, UOB offers a helpful tool called Debt Consolidation.

Benefits of Debt Consolidation

One of the key benefits of debt consolidation is that it allows you to combine all your outstanding debts into a single loan. By doing so, you can enjoy the convenience of making just one monthly repayment, simplifying your financial commitments. This not only helps in better tracking of your repayments but also reduces the risk of missing any payments and incurring late fees.

Moreover, when you opt for UOB’s Debt Consolidation plan, you may benefit from lower interest rates compared to what you are currently paying on your various loans or credit card debts. This can lead to substantial savings in the long run, helping you to pay off your debts more efficiently. Additionally, consolidating your debts can also improve your credit score as it shows that you are taking proactive steps to manage your finances responsibly.

Another advantage of UOB’s Debt Consolidation plan is the flexibility it offers in terms of repayment tenure. You can choose a repayment period that suits your financial situation, making it easier for you to manage your monthly cash flow. This customisation allows you to tailor the plan to fit your needs and budget, ultimately aiding you in becoming debt-free sooner.

Eligibility and Application Process

Managing your debt through UOB’s Debt Consolidation is straightforward. To be eligible, you typically need to be a Singaporean, Permanent Resident, or Foreigner with a minimum annual income. The application process involves submitting your personal and financial documents for assessment. Upon approval, UOB will consolidate your debts and provide you with a new repayment schedule.

When applying for debt consolidation, it’s imperative to review your current debts and financial situation carefully to determine if this is the right solution for you. By consolidating your debts, you are imperatively taking out a new loan to pay off existing debts. It’s crucial to ensure that you can commit to the new repayment terms to avoid falling into further financial difficulties. If you are unsure about whether debt consolidation is suitable for you, seek advice from UOB’s financial advisors who can provide you with personalised recommendations based on your circumstances.

Building Credit with UOB Credit Cards

Many financial institutions, including UOB, understand the importance of having a good credit score and report.

Credit Score and Report Analysis

With UOB Credit Cards, you have the opportunity to build and improve your credit score by maintaining a good repayment record. By regularly using your card for purchases and making timely repayments, you are demonstrating to credit bureaus that you are a responsible borrower. It’s necessary to review your credit report periodically to ensure all information is accurate and to identify any potential issues that may be negatively impacting your credit score.

Responsible Credit Card Usage

Many individuals tend to overlook the importance of responsible credit card usage. Responsible Credit Card Usage involves making timely repayments, avoiding maxing out your credit limit, and keeping track of your expenses. This way, you can prevent falling into debt and damaging your credit score. With UOB Credit Cards, you have access to features such as spending alerts and online statements, which can help you monitor your spending and stay within your budget. By using your credit card responsibly, you can build a positive credit history and improve your overall financial health.

An necessary aspect of responsible credit card usage is understanding the terms and conditions of your credit card agreement. It’s crucial to familiarise yourself with interest rates, fees, and repayment deadlines to avoid any surprises and ensure you can manage your credit card effectively. By reading the fine print and staying informed about your credit card terms, you can make wise financial decisions and avoid unnecessary charges or penalties.

Plus, by responsibly using your UOB Credit Card, you can unlock a range of benefits such as cashback rewards, air miles, and discounts on shopping, dining, and travel. These perks can help you save money and maximise the value of your purchases. Keep in mind, your credit card is a powerful financial tool that can work in your favour if used wisely. By leveraging the features and benefits offered by UOB Credit Cards, you can build a positive credit history and work towards achieving your financial goals.

Taking Advantage of UOB Promotions and Offers

Despite the everyday expenses you face, there are numerous opportunities for you to maximise your savings through UOB promotions and offers. By capitalising on these deals, you can stretch your pounds further and make the most of your banking experience with UOB.

Types of Promotions and Offers Available

Any savvy saver like yourself knows the importance of keeping an eye out for the latest UOB promotions and offers. UOB regularly rolls out various deals ranging from cashback rewards to exclusive discounts for dining, shopping, travel, and more. By taking advantage of these promotions, you can enjoy additional perks and savings on your everyday expenses.

| Cashback Rewards | Exclusive Discounts |

| Travel Deals | Dining Offers |

| Rewards Programmes | Shopping Promotions |

| Gifts and Prizes | Loan Interest Rates |

| Insurance Packages | Investment Opportunities |

After all, who wouldn’t want to make their money work harder for them and enjoy extra perks along the way?

How to Stay Informed about New Promotions

Promotions are the key to unlocking greater value from your UOB personal banking experience. By staying up to date with the latest offers, you can ensure that you never miss out on potential savings opportunities. Whether it’s signing up for UOB’s newsletter, following them on social media, or regularly checking their website, there are various ways for you to stay informed.

This approach not only helps you save money but also allows you to make the most of your banking relationships. By taking advantage of promotions and offers, you can enjoy additional benefits that enhance your overall banking experience. So, keep an eye out for new deals and start maximising your savings today!

Enhancing Security with UOB Online Banking

Now, let’s explore into how you can enhance the security of your online banking with UOB’s features. One critical aspect that sets UOB apart is its robust Two-Factor Authentication and Encryption measures.

Two-Factor Authentication and Encryption

Online security is paramount when it comes to banking, and UOB understands this. With Two-Factor Authentication, not only do you need a password to access your account, but you also require a second piece of information to verify your identity. This could be a unique code sent to your mobile device or generated by a security token. Additionally, UOB employs cutting-edge encryption technology to safeguard your data during online transactions, making it extremely challenging for hackers to intercept and decode any sensitive information.

By utilising Two-Factor Authentication and encryption, you add an extra layer of protection to your online banking activities. This means that even if someone manages to obtain your password, they would still need the additional authentication method to gain access to your account, keeping your finances safe and secure.

Safe Online Banking Practices

On top of UOB’s advanced security features, it’s crucial for you to follow safe online banking practices to further protect your accounts. Avoid logging into your online banking through public Wi-Fi networks, as these can be vulnerable to hacking attempts. Always ensure you log out after each session and never share your login credentials with anyone.

Understanding the importance of safe online banking practices is key to maintaining your financial security. By staying vigilant and following best practices, you can minimise the risk of falling victim to online scams or fraud. Recall, your diligence plays a significant role in keeping your hard-earned savings protected.

Customising Your Banking Experience with UOB

Unlike other banks, UOB offers a range of features to help you customise your banking experience according to your preferences. By leveraging these tools, you can truly tailor your financial management to suit your lifestyle and needs.

Personalized Account Management

Banking with UOB allows you to have personalised account management that caters to your unique requirements. From setting spending limits to creating savings goals and tracking your expenses, you have full control over how you manage your finances. This level of customisation empowers you to make informed decisions about your money, helping you stay on top of your financial health.

Furthermore, with UOB’s personalised account management, you can easily monitor your transactions in real-time, identify any unusual activity promptly, and take immediate action. This feature adds an extra layer of security to your banking experience, giving you peace of mind knowing that your finances are being closely monitored.

Customisable Alerts and Notifications

Banking with UOB gives you the flexibility to customise alerts and notifications to keep you informed about your account activity. You can set up alerts for various scenarios such as large transactions, low balances, or new payees added. These customisable alerts and notifications ensure that you are always aware of what’s happening with your money, helping you detect and prevent any fraudulent activities swiftly.

Your customisable alerts and notifications can be tailored to suit your preferences, whether you prefer email updates, SMS alerts, or push notifications through the mobile app. This level of personalisation not only keeps you informed in real-time but also empowers you to take control of your financial security.

Getting Support from UOB Customer Service

Multichannel Support Options

All UOB customers can access a range of multichannel support options to address their banking queries or concerns efficiently. You can reach out to UOB customer service via phone, email, or visit a local branch for in-person assistance. The UOB website also offers a live chat feature, allowing you to interact with a customer service representative in real-time. This multichannel approach ensures that you can choose the most convenient method of communication based on your preferences.

Tips for Effective Communication with Customer Service

Service interactions with customer service are more productive when you follow specific tips to enhance communication. Start by providing clear and concise details about your query or issue to the UOB representative. Stay calm and patient during the conversation, allowing the customer service agent to understand and address your concerns effectively. Additionally, it is important to listen attentively to the guidance provided and ask for clarification if needed. These communication strategies can lead to a quicker resolution of your banking issues.

- Provide clear and concise details about your query.

- Stay calm and patient during interactions.

- Listen attentively to the guidance offered.

For more effective communication with customer service, remember that remaining polite and respectful throughout the conversation can help foster a positive interaction. Avoid using jargon or technical terms that may not be easily understood by the customer service representative. Clearly state your expectations or desired outcomes, allowing the UOB team to assist you more effectively. Thou, being courteous and cooperative can go a long way in ensuring a satisfactory resolution to your banking queries.

Options

UOB provides various communication options for you to reach out to customer service, ensuring that you receive timely assistance for your banking needs. Whether you prefer phone, email, live chat, or in-person support at a local branch, UOB offers diverse channels to cater to your preferences. The availability of multiple communication avenues highlights UOB’s commitment to providing accessible and efficient customer service support. Remember to select the most suitable option for your query to ensure a seamless interaction.

Staying Informed with UOB Financial Education

Unlike other banks, UOB offers a range of resources to help you stay informed and improve your financial knowledge. One valuable feature is their extensive collection of online resources and tutorials, designed to guide you in making more informed decisions when it comes to managing your finances.

Online Resources and Tutorials

Informed choices are key to maximising your savings, which is why UOB provides a plethora of online resources and tutorials on various financial topics. From basic saving tips to complex investment strategies, these resources are tailored to suit your needs and help you navigate the world of personal finance with confidence. By taking advantage of these tools, you can equip yourself with the knowledge required to make informed choices that align with your financial goals.

Whether you are a novice looking to build your financial foundation or a seasoned investor seeking to enhance your portfolio, UOB’s online resources and tutorials can provide you with the necessary insights to make strategic decisions. Empower yourself with the expertise needed to secure your financial future and make the most of your savings potential.

Workshops and Seminars for Financial Literacy

Through their workshops and seminars, UOB goes the extra mile in promoting financial literacy among its customers. These interactive sessions cover a wide range of topics, including budgeting, investments, and retirement planning. By attending these events, you not only gain valuable knowledge but also have the opportunity to interact with financial experts who can offer personalised advice tailored to your specific needs.

Tutorials

This comprehensive approach to financial education sets UOB apart, ensuring that you have all the tools necessary to make sound financial decisions. By participating in workshops and seminars, you can enhance your financial acumen and gain insights that can help you maximise your savings potential. Don’t miss out on these invaluable opportunities to improve your financial literacy and secure a stable financial future.

To wrap up

Upon reflecting on Maximizing Your Savings With UOB Personal Banking Features, it’s clear that taking advantage of the various tools and products offered by UOB can significantly boost your savings potential. By using features such as the UOB One Account, Mighty FX, and digital banking services, you can streamline your financial activities and make your money work harder for you.

Bear in mind, it’s crucial to regularly review your financial goals and adjust your banking strategy accordingly. Whether you’re aiming to build an emergency fund, save for a major purchase, or grow your investments, UOB’s personalised banking solutions can cater to your specific needs and preferences. By staying informed about the latest promotions and offerings from UOB, you can make informed decisions that align with your financial objectives.

Thus, by making the most of UOB’s range of personal banking features, you can take proactive steps towards achieving your savings goals and securing your financial future. With the right tools and strategies at your disposal, you can navigate the world of personal finance with confidence and ease, knowing that you are maximising your savings potential every step of the way.

Q: What are some key features of UOB Personal Banking for maximising savings?

A: UOB Personal Banking offers features such as high-yield savings accounts, automated savings plans, and cashback rewards to help you maximise your savings.

Q: How can I earn higher interest rates with UOB Personal Banking?

A: By opening a UOB high-yield savings account and maintaining a minimum balance, you can earn higher interest rates than traditional savings accounts.

Q: What is an automated savings plan, and how can it benefit me?

A: An automated savings plan allows you to set aside a portion of your income regularly, helping you save consistently without having to remember to do so manually.

Q: How can cashback rewards help me save money with UOB Personal Banking?

A: UOB Personal Banking offers cashback rewards on eligible purchases, allowing you to earn back a percentage of the amount spent and save money in the process.

Q: Are there any tips for effectively maximising savings with UOB Personal Banking features?

A: To maximise your savings with UOB Personal Banking, consider setting specific savings goals, reviewing your expenses regularly, and taking advantage of promotions and rewards offered by the bank.