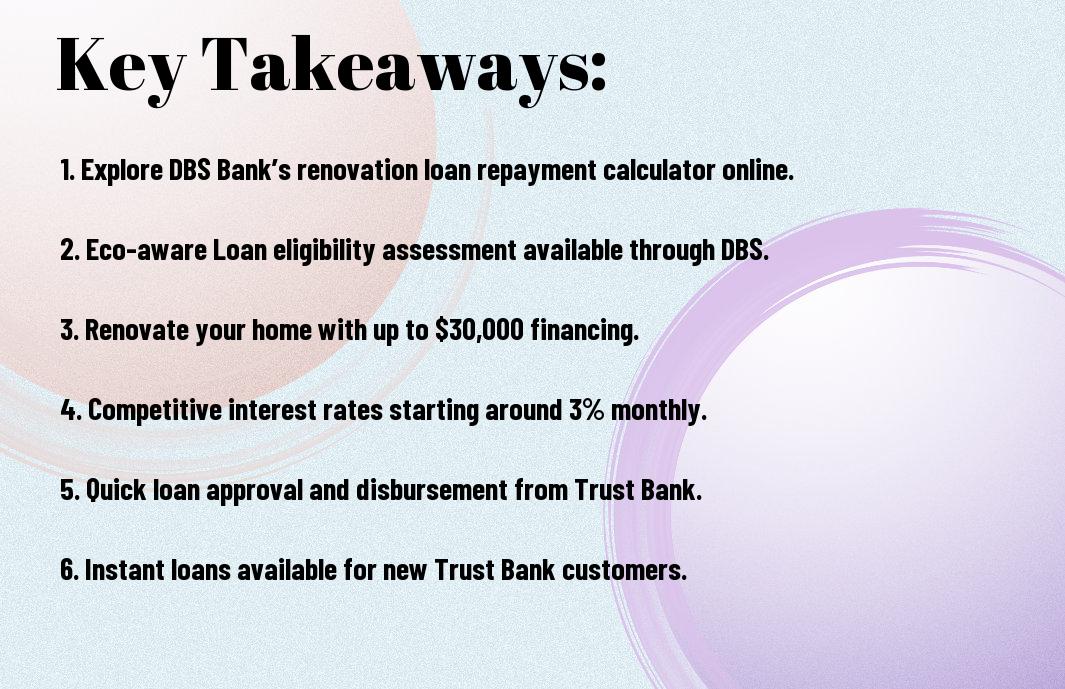

Calculator tools like those offered by DBS Bank and Trust Bank can alleviate your renovation loan worries. I’m here to guide you through the calculations and options available, whether you’re looking to estimate monthly repayments or checking your eligibility for specific offers like the Eco-aware Loan. With a focus on affordability and fast approval, I’ll help you navigate the best choices for your home interior project, ensuring you feel confident in your financial decisions.

Understanding Renovation Loans

For many homeowners, the idea of renovating can bring on a wave of excitement mixed with a pinch of anxiety. I find that the financial aspect of it all often creates the most apprehension. A renovation loan can really help alleviate some of those concerns by providing the funds needed to transform your living space. Essentially, a renovation loan is a specific type of financing designed to cover the costs of upgrading your home, whether that’s a new kitchen, bathroom remodel, or even a fresh coat of paint.

What is a renovation loan?

Against the backdrop of my own renovation dreams, I’ve discovered that renovation loans are structured to provide lump-sum payments that can help you pay for various projects in your home. Lenders tend to have specific criteria for these loans, including the amount you’re seeking and the nature of the renovations. By understanding what is required, I can approach the application process more confidently, ensuring that I have a clear plan in place before I start tearing down walls.

Benefits of Renovation Loans

With the right renovation loan, I can significantly ease the financial burden of my project. These loans typically offer competitive interest rates and flexible repayment plans, making it easier for me to manage my budget. Additionally, many lenders are responsive to the urgency of home improvements, providing quick approval and disbursement of funds. This means I can start my renovation sooner rather than later, which is always a bonus!

But the real charm of a renovation loan lies in its ability to transform a house into a home that truly reflects my personality and lifestyle. By opting for a loan specifically tailored for renovations, I can avoid the stress of financing the project through savings alone. It allows me to invest in my home, enhancing its value while creating a more enjoyable living environment for myself and my family.

Evaluating Your Loan Options

One of the first steps in beginning a renovation journey is to evaluate your loan options thoroughly. Each lender offers different products, and it’s important to sift through these to find one that best suits your financial situation. By understanding what’s available, you can make an informed decision that aligns with your goals for your home. From personal experience, it’s vital to shop around and not rush into the first loan option that comes your way. I’ve found that taking my time can lead to discovering more favourable terms and conditions.

Comparing Interest Rates

An important aspect of choosing a loan is comparing interest rates. The rates can vary significantly between banks, and even minor differences can affect the overall cost you incur over time. Below is a brief comparison of some common loan options:

| Bank | Interest Rate |

|---|---|

| DBS Bank | About 3% per month |

| Trust Bank Singapore | Low rates, no fees |

| TCC Company | Up to 3% per month, up to $30,000 |

Loan Tenure and Repayment Plans

Among the many factors you’ll want to consider, loan tenure and repayment plans play a significant role in shaping your financial commitment. A longer tenure often translates to lower monthly instalments, which can alleviate some financial pressure. However, it’s important to keep in mind that while your payments may be less, you could end up paying more in interest over the life of the loan. I’ve always found it beneficial to draft a detailed budget that reflects these elements to map out what I can realistically afford each month.

Another aspect of repayment plans that I have encountered is the flexibility they may offer. Some banks provide various options, allowing you to choose a plan that fits your lifestyle and finances. For instance, I appreciate loans that allow me to make extra repayments without penalties, as it gives me a sense of control. By carefully considering these options, you can tailor a plan that meets your renovation needs and ensures that your financial wellbeing is taken into account.

Getting Approved for a Renovation Loan

Once again, navigating the world of renovation loans can feel a bit overwhelming, but I’m here to help you through it. It’s all about understanding what you need to do and what lenders are looking for when it comes to approving your loan. A well-prepared application can significantly increase your chances of getting that renovation loan approved, allowing you to transform your space into something truly special.

Eligibility Criteria

The first step in obtaining a renovation loan is to check whether you meet the eligibility criteria set by the lender. This criteria typically includes factors such as your income level, credit score, and existing financial commitments. You want to ensure that you have a stable income, as lenders will often seek a reliable source of repayment. It’s also wise to keep an eye on your credit report, as a good credit rating can make the lending process smoother and may even result in more favourable interest rates.

Fast Approval Processes

Getting your application through quickly is often a top priority for many, and thankfully, the fast approval processes many banks offer can help you achieve that. I find that some lenders provide an online application that can be completed in minutes, streamlining the entire process. By using technology, you can receive a decision on your loan application much faster than traditional methods, allowing you to get started on your renovation sooner rather than later.

Processes differ from one lender to another, but many have dedicated teams that fast-track applications when they meet specific criteria. For instance, Trust Bank Singapore boasts an Instant Loan service that offers approval in as little as 60 seconds. This swift approach saves time and reduces the stress that often comes with waiting for loan decisions. So, make sure to explore your options and choose a lender with a fast and efficient approval process to ease your renovation journey.

Calculating Your Monthly Repayment

To ensure that I’m making informed decisions regarding a renovation loan, calculating my monthly repayment is crucial. I often start by considering the total amount I wish to borrow for my home improvement project and the interest rate offered by the lender. The repayment amount will vary depending on the length of the loan’s tenure, which I can customise to suit my financial situation. It’s a straightforward process, and it allows me to plan my budget accordingly.

Using Online Calculators

Above all, the use of online calculators makes this process incredibly easy. I can simply input details like the loan amount, interest rate, and tenure, and within seconds, I have an estimate of what my monthly repayments will look like. Various banks, such as DBS Bank and Trust Bank, offer these calculators on their websites, which I find very handy. They not only help me gauge affordability but also allow me to compare different options available in the market.

Factors Influencing Repayment Amount

About the repayment amount, several factors play a role that I should consider. These include the loan interest rate, the total amount borrowed, and the loan tenure. Additionally, the bank’s assessment of my creditworthiness may influence the terms I receive, which can ultimately affect how much I pay each month. Below are some of the main factors to contemplate:

- Interest rate offered by the lender

- Total loan amount required for my renovation

- Length of the repayment period

The final amount I pay each month hinges upon a combination of these factors, so it is worth taking the time to analyse them before I commit.

Due to variations in the above factors, it is crucial for me to remain attentive when calculating my monthly repayments. For instance, a lower interest rate can significantly reduce my total repayment amount, while extending the loan tenure may decrease my monthly payments but leave me paying more in interest over time. I aim to strike a balance that suits my financial capabilities. Here’s what else influences the repayment amount:

- Fees associated with the loan

- Discounts or promotions offered by the lender

- My credit score and history

The more informed I am about these factors, the better decisions I can make regarding my renovation loan.

Eco-aware Loan Benefits

Many individuals are becoming increasingly aware of the impact their choices have on the environment. This growing consciousness has led to the introduction of eco-aware loans, which not only help fund your renovation projects but also promote sustainable practices. By opting for an eco-aware loan, you can enhance your home’s efficiency while making a positive impact on the planet. This means embracing energy-efficient appliances, sustainable materials, and environmentally friendly design principles in your renovation, ultimately resulting in savings on your utility bills and a reduced carbon footprint.

Sustainable Renovation Considerations

Between energy efficiency and sustainable materials, there are numerous considerations to keep in mind when planning your renovation. It’s vital to select products that are not only stylish but also environmentally friendly. By opting for renewable resources, such as bamboo flooring or recycled heating systems, I can create a space that reflects my taste while being kind to the earth. These choices can significantly contribute to a more sustainable lifestyle, proving that eco-conscious renovation isn’t just a trend but a lasting commitment.

Additional Perks for Eco-friendly Choices

The benefits of making eco-friendly choices extend far beyond personal satisfaction. Many financial institutions that offer eco-aware loans provide additional perks, such as lower interest rates or cashback incentives for homeowners who invest in sustainable renovations. This is a fantastic opportunity for me, as it not only reduces my overall cost of the loan but also encourages an environmentally responsible approach to home improvement.

Further, these additional incentives can lead to a more substantial return on investment in the long run. By choosing to enhance my home with sustainable materials and energy-efficient practices, I can enjoy lower utility costs and possibly even an increase in property value. It’s a mutually beneficial situation where I can enhance my living space while simultaneously making a positive impact on the environment.

Choosing the Right Bank for Your Needs

All I want is to help you navigate through the myriad of options when it comes to financing your renovation project. Selecting the right bank for your needs can significantly impact your renovation journey. Different banks have different loan offerings, interest rates, and repayment terms, so I recommend considering what matters most to you—whether that’s low interest rates, flexible repayment options, or quick approval times.

DBS Bank Offerings

About DBS Bank, they provide a range of renovation loan options tailored to suit various needs. I can quickly calculate the monthly repayments using their renovation calculator by entering the loan amount and the desired tenure. The Eco-aware Loan is particularly appealing, as it supports eco-friendly renovation projects, allowing me to contribute to a sustainable environment while renovating my home.

Trust Bank Competitive Rates

Any time I think of competitive loan rates, Trust Bank comes to mind. They offer renovation loans with incredibly low rates, which can certainly lighten the financial load. The process is straightforward too; I can apply for an instant loan and have my funds ready within a mere 60 seconds, making it super convenient for those eager to get started on their home improvements without a lengthy wait.

In addition to low rates, Trust Bank doesn’t impose extra fees, which means I can focus on my renovation without worrying about hidden costs. This transparency is refreshing and fosters trust, making me feel confident in my choice. Overall, choosing a bank that aligns with your renovation needs can make all the difference, so I encourage you to explore the various offerings to find the perfect fit for you.

Summing up

Conclusively, navigating the world of renovation loans can feel a bit overwhelming, but with the right tools and information, it doesn’t have to be. I found that using calculators like those provided by DBS Bank and Trust Bank helped clarify my options, allowing me to see potential monthly repayments and understand what I could afford. It’s reassuring to know that there are low interest rates available, and with some banks offering fast loan approval, my renovation dreams could soon become a reality.

Ultimately, the key is to assess your needs and compare the various offerings available. As I evaluated my options, I discovered the benefits of finding the right loan that fits my budget while also considering the eco-aware loans that are on the market. So whether you’re planning a small update or a complete overhaul of your home, taking the time to calculate your renovation loan fear factor can lead to informed decisions and a smoother renovation journey.

FAQ

Q: What is the process for applying for a renovation loan through DBS Bank?

A: To apply for a renovation loan through DBS Bank, you can visit their website and use the renovation calculator to determine your potential monthly repayments. Once you’ve gathered the necessary documentation, such as proof of income and identity, you can submit your application online or visit a branch for assistance. After review, if approved, funds are typically disbursed quickly to aid your renovation project.

Q: What are the interest rates for renovation loans offered by Trust Bank?

A: Trust Bank offers renovation loans at competitive rates starting from approximately 3% per month. This positions it as one of the more affordable options available for financing home improvement projects, allowing you to budget effectively for your renovation.

Q: How can I find out if I qualify for the Eco-aware Loan?

A: To check your eligibility for the Eco-aware Loan, you can use the dedicated calculator on the DBS Bank website. The calculator will guide you through the criteria, allowing you to input key details like your income and renovation costs to ascertain if you meet the qualifications for this eco-friendly financing option.

Q: What amount can I borrow for home renovation loans?

A: Depending on the lender, you can typically borrow up to $30,000 for home renovations. Each bank may have different policies and conditions regarding the maximum amount, so it’s advisable to review individual lender details or consult with their representatives for precise limits based on your financial circumstances.

Q: How quickly can I expect loan approval and disbursement?

A: Both DBS Bank and Trust Bank are known for their prompt loan approval processes. Generally, you can expect approval and disbursement within a short timeframe—often within minutes for Trust Bank’s Instant Loan feature. For DBS Bank, the turnaround can vary but is usually efficient, ensuring you can start your renovation without undue delay.