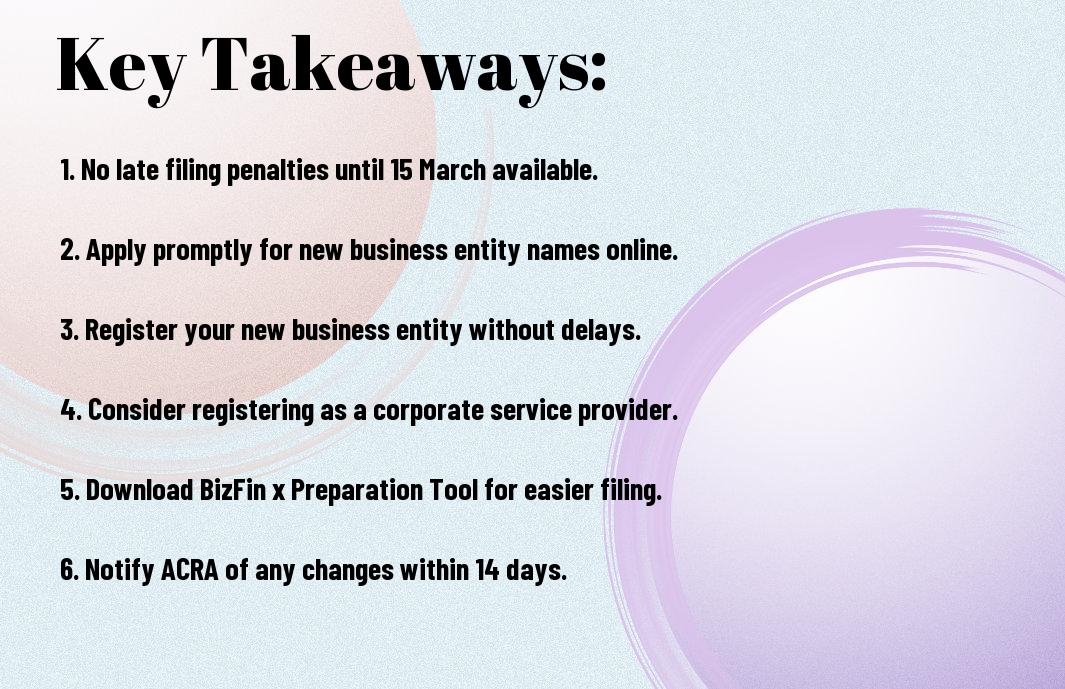

With ACRA BizFile, it’s easy to miss some handy tips that could save you time and headaches. For instance, did you know that there are no late filing penalties until 15 March? I’ll also shed light on how to apply for a new business entity name, register it, and even become a corporate service provider. Plus, I’ll guide you through downloading the BizFin x Preparation Tool to help streamline your experience. Let’s explore the nitty-gritty and ensure you’re well informed!

Deadlines: The Clock Is Ticking

Let me remind you that time does not wait for anyone. It’s like that friend who always shows up late to dinners but expects everyone to wait. The ticking clock reminds you that filing deadlines are as real as that last piece of cake you promised to share. Sure, you’re blessed with a grace period until 15 March, but it’s a double-edged sword. While procrastination may seem appealing, is it worth taking such a risk?

As the deadline approaches, the reality that you might still have a few pesky documents to sort out can feel like a weight on your shoulders. The grace period might seem like a nifty little cushion, but be warned: it’s not an excuse to sit back and take it easy. When deadlines loom, it’s all sunny skies until suddenly you’re in a storm of stress with that deadline creeping up on you like an unwanted tax bill.

Understanding the 15 March Grace Period

Any savvy entrepreneur knows that the 15 March grace period serves as a comfy buffer zone designed to ease your filing worries. It’s a bit like being given an extra week to study before that big exam. Sure, you won’t be slapped with late filing penalties during this time, but let’s not kid ourselves. A grace period is a great time to get your ducks in a row, but it’s not an excuse to throw caution to the wind. Make good use of it, and you might successfully avoid a filing fiasco.

For those of you who may feel invincible, take heed: it’s a charming little opportunity to ensure everything’s in order, but it won’t last forever. I mean, who wants to live in a state of existential dread about missing a deadline? Better safe than sorry, they say! So, arm yourself with organisation and keep your eye on the prize—timely submissions.

Consequences of Missing Filing Deadlines

Fear of missing a filing deadline is a prevalent concern across all sectors. You may believe that a minor error is insignificant, but I assure you, it can escalate rapidly. Penalties for late submissions can be overwhelming and financially devastating. And let’s be honest; nobody wants to dip into their coffee fund to pay for a late fine.

Filing deadlines may seem like an ever-present footnote in business life, but they carry hefty consequences if neglected. Neglecting filing deadlines can not only result in financial penalties but also negatively impact your business’s reputation. You know that one friend who always forgets your birthday? You don’t want to be that friend in the business world! Let’s face it; the road to running a successful business is already riddled with challenges, so let’s keep filing on your list of things to do—right at the top!

Entity Registration Essentials

While venturing into the world of business registration, the crucials can sometimes feel like a labyrinth with no exit signs. With so much information swirling around, it’s easy to get lost in the minutiae. However, once you grasp the fundamentals of entity registration, you’ll find that the process can be quite straightforward. ACRA BizFile guides you through the requirements and ensures you stay compliant with the law throughout this journey. You must take the necessary steps to guarantee the smooth operation of your business from the outset.

Choosing and Applying for Business Names

Between the allure of a catchy name and the practicalities of business registration, choosing the perfect name can feel like picking a favourite child—nearly impossible! Striking a balance between creativity and compliance is crucial to ensure your chosen name not only reflects your imagination but also resonates with your target audience. Once you’ve settled on a name that sings to you, applying for it through ACRA is your next step—just don’t forget to check if it’s already been snapped up by someone else!

Streamlining the Registration Process

Once you’ve exhausted your search for the ideal business name, you may be wondering how to ensure the registration process runs as smoothly as a fine whisky. It’s all about being organised and knowing what to expect. Prepare all necessary documents and information in advance, so when you hit that ‘submit’ button, you won’t be left tearing your hair out at the vague requirements or unexpected questions. Once everything clicks into place, you’ll be one step closer to launching your business with minimal fuss! I find that a little preparation can turn what seems like a complicated maze into an inviting walkway.

Due to the online nature of ACRA BizFile, the whole registration process has been significantly simplified. Gone are the days of lengthy queues and piles of paperwork. By adopting a proactive approach and keeping all your details easily accessible, you can streamline the application process, freeing up your time to concentrate on what really matters – expanding your brand and fostering connections with your audience. So go on, take a deep breath and enjoy the journey!

BizFin x Preparation Tool: Your Secret Weapon

To navigate the world of ACRA BizFile with the finesse of a seasoned pro, I can’t emphasise enough how the BizFin x Preparation Tool can be a genuine game-changer for you. Whether you’re a veteran entrepreneur or just dipping your toes into the business waters, having this tool in your arsenal transforms the sometimes daunting task of filing into a straightforward and almost enjoyable affair. Forget about sifting through mountains of paperwork like a treasure hunt gone wrong; this nifty application is designed to streamline the process and keep you on track without the unnecessary headaches.

Download and Installation Guide

Download the BizFin x Preparation Tool with a click of a button from the official ACRA website. Once you’ve got it downloaded, installation is as easy as pie—simply follow the on-screen prompts, and in no time, you’ll be ready to start sorting your business filings like a seasoned maestro. Just make sure your computer meets the system requirements, and you’re all set to embrace your new digital companion.

Making the Most of the Tool’s Features

Secretly, this tool is brimming with features designed to take the pain out of compliance. From helping you fill out forms correctly to ensuring you don’t miss a deadline, I can assure you that it’s got your back. Dive into its various functions, and you’ll quickly discover how it can assist you in keeping your ACRA filings on point. With its straightforward interface and handy prompts, I found it turned paperwork from drudgery into a much less tedious task.

Understanding the myriad of features available within the BizFin x Preparation Tool amplifies your efficiency in ways you might not initially realise. The user-friendly design allows me to navigate seamlessly, ensuring I can focus on what truly matters: growing my business. Whether it’s generating reports, tracking submissions, or getting alerts for updates, each feature is tailored to enhance your experience and boost your confidence in managing compliance like a savvy entrepreneur. Trust me, once you start using it, you won’t know how you ever managed without it!

Compliance Requirements

After plunging into the intricate world of ACRA BizFile, you’ll soon realise that compliance doesn’t just wave its wand and disappear. In fact, it’s more like a persistent mosquito that buzzes around until you get it sorted. You see, maintaining your business’s integrity in Singapore is about more than just the initial filing; it requires constant attention and diligence on your part. Nobody wants to find themselves in trouble because they overlooked a minor detail, right? Stay savvy, and you’ll breeze through these requirements with the finesse of a seasoned pro.

Mandatory Information Updates

To keep your business in tip-top shape, it’s paramount that you keep ACRA informed about any changes. Whether it’s your business address shifting to a new swanky location or introducing new activities, all these little updates make a difference. If you think for a moment that you can just put your feet up and relax once you’ve registered, think again! Updating your information is as vital as remembering your morning coffee; one lapse can lead to confusion and potential penalties down the road.

The Critical 14-Day Notification Window

On that note, let’s talk about the infamous 14-day notification window. This little gem means you have a short fortnight to inform ACRA about any alterations after they happen. Just picture it: you’ve moved your office or decided to take your sandwich shop into the vegan realm, and now the clock is ticking! If you fail to notify them in time, you might expose yourself to unwanted repercussions. Nobody wants to be the business owner who thought, “Oh, I’ll get to that later!” only to be reminded at the worst possible moment.

Indeed, this 14-day window is less of a leisurely stroll and more of a sprint, so be vigilant! You’ll want to make it a habit to check for any potential updates regularly. Treat it as a little health check for your business; staying ahead of these notifications can save you both time and money, and let’s be honest, who doesn’t want that? Therefore, overcome procrastination and complete those updates before they become a burden.

Common Filing Mistakes

Many individuals jump headfirst into the ACRA BizFile process, believing that common sense will see them through. Alas, the devil is in the details, and overlooking the nitty-gritty can lead to unnecessary headaches—or worse, delays in your business registration. It’s easy to underestimate the importance of accurate information, but one misplaced letter in your business name or an incorrect registered address can create a chain of administrative chaos. I’d suggest you actually take a moment to double-check everything before hitting that all-important submit button; the consequences of negligence can be quite amusing in hindsight, but I suspect you’d prefer to avoid a slapstick comedy at your expense!

Documentation Errors to Avoid

Beside the obvious blunders, like spelling errors and missed signatures, it’s vital to scrutinise the specific documentation requirements for your business entity type. Each entity has its own unique set of forms and regulations, and using the wrong template can lead to amusing outcomes, like submitting an application for a private limited company when you’re actually trying to register a partnership. I’ve found that keeping a checklist handy helps avoid these documentation disasters, allowing you to tick off each requirement as you go—think of it as your personal filing fairy godmother. And trust me, a little preparation goes a long way to keeping the pixies away from your paperwork!

Verification Steps Before Submission

Above all else, you must undergo a rigorous verification process before sending anything off to ACRA. It’ll save you from the embarrassment of realising you’ve entered the wrong financial information or misclassified your business activities—like when I mistakenly categorised my bakery as a tech start-up (sadly, cupcakes do not count as software). Take the time to cross-reference your documents against the required formats and details, and don’t hesitate to consult the BizFin x Preparation Tool for guidance. This handy tool can be your best mate as you navigate the paperwork, ensuring that all entries are up to snuff.

Also, it’s wise to enlist a second set of eyes for your documentation review. I often find that my friends spot errors I’ve glossed over—bless their keen attention! Consider it similar to proofreading an important essay: you might ‘know’ what you meant, but if it’s not translating well on paper, you might end up with a submission that raises eyebrows for all the wrong reasons. So, go forth and verify; your future self will be grateful!

Corporate Service Provider Registration

Now, venturing into the world of corporate service provider registration, it’s worth noting that this venture can be quite the maze if you’re not clued up on the ins and outs. One of the first steps to take is to ensure you meet the fundamental qualifications required by ACRA. This means being a Singapore resident or having a local office in Singapore. You’ll need to have the appropriate qualifications and experience, which often includes financial services, compliance, and potentially holding relevant licences. In short, if you’re looking to offer corporate services, you’ll need a blend of expertise, credibility, and a penchant for navigating through red tape.

Requirements and Qualifications

Corporate service provider registration isn’t a free-for-all; there are specifics you need to tick off first. For starters, having a proper business structure in place is a must. This means you can’t simply set up shop in your living room with a few pieces of paper and a dream; you need a legitimate business entity; perhaps a private limited company. Furthermore, the key players in your business, namely the directors and shareholders, should have impeccable reputations and a solid grounding in corporate governance. I suggest brushing up on your knowledge of company law and compliance regulations as well—it’ll serve you well.

Benefits of Becoming a Registered Provider

Before you think about registering, let me regale you with the many perks that come with being a registered corporate service provider. Firstly, once you’re officially registered with ACRA, you gain a stamp of legitimacy that can work wonders for your clientele’s trust. You’ll be seen as a credible authority in your field, and that can’t be understated when it comes to attracting new business. Not to mention, being a registered provider allows you access to a plethora of resources, networking opportunities, and platforms that can aid in growing your corporate service practice.

In addition, I’ve found that registered providers have a unique advantage in securing clients over those who choose to operate in the shadows. Having ACRA’s backing gives you an edge, making potential clients more comfortable in engaging your services. Plus, with a growing demand for outsourced corporate services, your opportunities for making a mark in the industry become significantly heightened. Think of it as having your golden ticket to ride the corporate service carousel—it’s quite a delightful ride if I do say so myself!

Taking this into account, I cannot stress enough how the most overlooked advice regarding ACRA BizFile pertains to the deadlines and formalities involved. The fact that there are no late filing penalties until 15 March feels like a hidden treasure that most budding entrepreneurs seem to ignore. With this information, you can take a deep breath and plan your registration and filings with a calm mind. Plus, applying for a new business entity name and registering as a corporate service provider doesn’t have to be a Herculean task—it’s all just a part of the joyful entrepreneurial journey!

Furthermore, I can’t help but chuckle at the simplicity of using the BizFin x Preparation Tool, which is as easy as pie (or should I say, as easy as sorting out your paperwork). By taking the time to download and utilise this handy little tool, you virtually guarantee your compliance and streamline your processes. Just ensure you keep ACRA updated about any changes within a fortnight—no one likes an unexpected surprise! Now, armed with this sage advice, it’s time for you to conquer those regulatory hurdles and let your business dreams flourish!

FAQ

Q: What is ACRA BizFile and why is it important for businesses?

A: ACRA BizFile is an online filing system used by the Accounting and Corporate Regulatory Authority (ACRA) of Singapore for the registration and management of companies and business entities. It is important for businesses as it provides a streamlined process for registering a new business, applying for entity names, and filing compliance documents, ensuring that businesses remain compliant with local regulations.

Q: What does the announcement regarding ‘no late filing penalties until 15 March’ mean for businesses?

A: The announcement indicates that businesses in Singapore will not incur penalties for late filing of annual returns until 15 March of the upcoming financial year. This provides a temporary relief for businesses, allowing them additional time to ensure that their filings are accurate and complete without the fear of financial penalties.

Q: How can I apply for a new business entity name through ACRA BizFile?

A: To apply for a new business entity name, you will need to access the ACRA BizFile portal. After logging in, look for the option to apply for an entity name under the ‘New Registration’ section. You will be required to input your desired name and check its availability against existing registered names. If the name is available, you can proceed with the application.

Q: What steps do I need to take to register a new business entity on ACRA BizFile?

A: To register a new business entity via ACRA BizFile, you first need to create an account or log in to your existing account. Then, select the ‘Register a New Business’ option and follow the prompts to provide necessary details such as the entity name, business address, activities, and the particulars of the owners and directors. Finally, review your application and make the payment for the filing fee.

Q: What should I do if there are changes to my registered business information?

A: If there are changes to any information registered with ACRA, such as the business address or activities, you are required to notify ACRA within 14 days of the change. This can be done through the ACRA BizFile portal by logging in and selecting the option to update your business details. Keeping your information up to date is imperative for compliance and maintaining good standing with ACRA.