Understanding Lasting Power of Attorney (LPA)

What is a Lasting Power of Attorney?

Your journey into understanding the Lasting Power of Attorney (LPA) begins with recognising its purpose. An LPA is a legal document that allows you, the donor, to appoint one or more individuals, known as donors, to act on your behalf. This appointment comes into play if you encounter situations where you may lose your mental faculties, enabling trusted individuals to make decisions related to your personal welfare, property, and financial matters. In essence, it serves as a safeguard, ensuring that your preferences are honoured even when you cannot articulate them yourself.

Before initiating the process, it is important to consider the types of decisions you would want your donee to handle. The LPA can encompass a wide range of decisions, from managing your finances to making healthcare choices. The ability to choose the people you trust most for these responsibilities is one of the significant advantages of having this legal document in place.

The Importance of Having an LPA in Singapore

Attorney, establishing a Lasting Power of Attorney in Singapore is necessary for securing your future and ensuring that your wishes are respected. Life is unpredictable, and unforeseen events can impact your ability to make decisions. An LPA provides peace of mind, knowing that someone you trust is legally empowered to act on your behalf should the need arise. This not only protects your interests but also alleviates the burden on your family during emotionally challenging times.

The importance of an LPA extends beyond individual preference; it creates a legal framework that simplifies decision-making for your loved ones if you become incapacitated. Without an LPA, your family may face the lengthy and potentially costly process of applying to the courts for a deputyship, which can create additional stress during difficult times. Thus, having an LPA ensures that your choices are upheld while easing the strain on those who care for you.

Who Can Be a Donor?

Having the authority to be a donor requires you to be at least 21 years of age in Singapore. This stipulation ensures that you are capable of making informed decisions regarding your personal and financial well-being. As a donor, you have the unique opportunity to select individuals you deeply trust to fulfil this role. They could be family members, close friends, or even professional advisors who understand your values and preferences.

A key aspect to consider is that anyone you choose as a Donee should be someone with good judgement and the ability to handle the responsibilities of managing your affairs, should the need arise. This responsibility is not to be taken lightly, so take your time in selecting the right individuals for this significant role.

Legal Implications of an LPA

At its core, a lasting power of attorney carries important legal implications that safeguard both your rights and the rights of your beneficiaries. By creating an LPA, you are giving legal authority to your chosen individuals to make decisions on your behalf. This document adheres to specific regulations outlined by the Mental Capacity Act in Singapore, ensuring that there is a robust legal framework governing the actions of your Donee. Understanding these regulations is key to ensuring a smooth transition of power, should it be required.

It is also imperative to recognise that, while you grant authority to your donor, you still retain certain rights. An LPA does not strip you of your ability to make decisions; it simply provides alternatives should you become unable to manage your affairs. This balance of authority and autonomy serves to protect your interests while promoting responsible decision-making.

Key Takeaways:

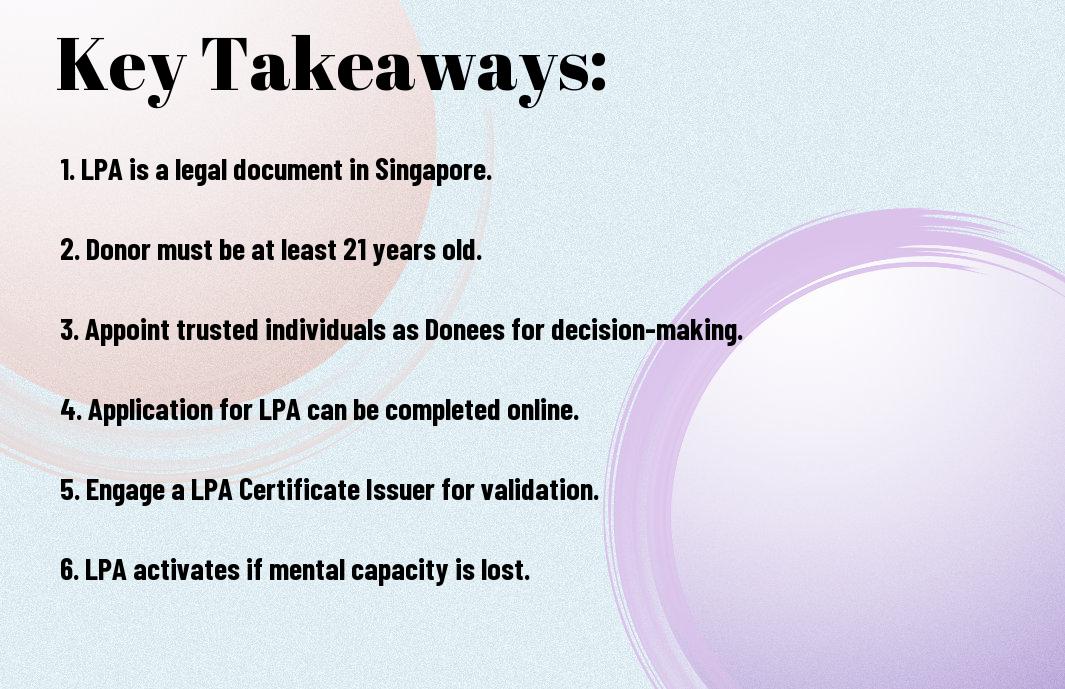

- Legal Document: The Lasting Power of Attorney (LPA) is a formal legal document in Singapore that allows individuals to appoint others to make decisions on their behalf.

- Eligibility: To create an LPA, the donor must be at least 21 years old, ensuring they have the legal capacity to make this decision.

- Appointing Donees: The donor can select one or more donees whom they trust to act on their behalf, which is imperative for personal affairs management.

- Application Process: The process involves starting an application online, finding an LPA Certificate Issuer, and registering the LPA to make it legally binding.

- Mental Capability: The LPA is particularly important for individuals concerned about losing mental capacity in the future, allowing trusted persons to make decisions if necessary.

The Process of Creating an LPA

It can certainly seem overwhelming to think about creating a Lasting Power of Attorney (LPA), but don’t worry, the process is straightforward and designed to protect your interests. By taking the necessary steps, you can ensure that your wishes are respected should you someday find yourself unable to make decisions for yourself. Your first key decision is selecting your Donee, the trusted individual or individuals you want to act on your behalf when necessary.

Key Steps to Appointing a Donee

After deciding to create an LPA, the first key step is to carefully consider who you want to appoint as your nominee. This person should be someone who understands your values and can make decisions that reflect your wishes. You can choose to appoint one donee or multiple donees, which can provide an additional layer of support and accountability.

Once you’ve selected your recipient, you should discuss your decision with them to ensure they are willing to take on this important responsibility. This conversation can also help clarify any specific wishes you may have regarding your care and financial management, making it easier for your Donee to represent your best interests.

How to Start Your Application Online

Application for your LPA can be seamlessly done online, which makes the entire process much more convenient. You’ll first need to visit the official website where the application system is hosted. From there, you can fill out the necessary forms, providing information about yourself and your chosen recipient.

After completing the online form, you will be prompted to review your details carefully. Ensure that all information is accurate because any discrepancies may lead to delays in processing your application. Once you’re satisfied, you can proceed to submit your application electronically.

Essential Documentation Required

You must gather and submit specific documents as part of your LPA application. Primarily, you will require identification documents for both yourself and your chosen donor, which may include NRICs or passports. Additionally, if you’re appointing multiple doers, it’s important to clarify how decisions will be made amongst them.

Moreover, if either you or your donor have any specific medical records that could be pertinent to decision-making, having these prepared beforehand can save you time and ensure that your LPA accurately reflects your preferences.

Navigating the LPA Online Portal

Around the time you submit your application, it’s important to get comfortable with navigating the LPA online portal. After submitting your application, you will need to track its progress and possibly respond to any queries or requests for additional information. The portal is designed to be user-friendly, guiding you through each step of the process.

Consequently, spending some time familiarising yourself with the portal can greatly simplify your experience. The website typically offers helpful resources and FAQs that can assist you in case you encounter any uncertainties along the way.

Choosing the Right Donee

Many people find the process of selecting the right nominee for their Lasting Power of Attorney (LPA) a challenging task. After all, this person will be entrusted with making significant decisions on your behalf should the need arise. It’s important to choose someone who understands your values and preferences, as well as someone who can handle the responsibilities that come with this role. The ideal candidate should be someone who is reliable, compassionate, and possesses good decision-making skills. This way, you can have peace of mind knowing that your interests will be taken care of even when you may not be able to voice your opinions.

Qualities to Look for in a Donee

Beside the important qualities like trustworthiness and reliability, it’s advisable to look for someone who has a good grasp of your financial situation and can communicate effectively with family members and professionals on your behalf. Ideally, your donor should be someone who is both emotionally mature and capable of handling pressure, as they might face difficult choices regarding your welfare. A good donor will not only respect your wishes but will also advocate for your best interests during challenging times.

Alternatives to Consider: Co-Donees

About the importance of having the right Donee, it’s worth considering the option of appointing co-Donees. Appointing two or more Donees can provide a sense of balance, ensuring that decisions are made collaboratively. This can be especially beneficial in situations where the responsibilities may be overwhelming for one person alone or when there are differing opinions on what actions should be taken. Co-donees can support each other, share the load, and provide different perspectives on important matters.

Consequently, when selecting co-donees, it’s vital to ensure that they can work well together and respect each other’s opinions. Open communication and trust are key in preventing conflicts that may arise in decision-making. Additionally, consider how they might handle disagreements and ensure they have a mutual understanding of your desires and intentions. This collaborative approach can safeguard your interests and provide a comprehensive support system in case of unforeseen circumstances.

Discussing Your Decision with Potential Donors

By taking the time to discuss your decision with potential employees, you can help to set clear expectations and ensure that they are prepared for the role you are considering them for. It’s a good idea to explain your reasons for choosing them and discuss the responsibilities they would hold. This conversation can also give them the opportunity to ask questions or express any concerns, ultimately leading to a better understanding of what is required of them.

Donee conversations are not just about sharing your intentions; they also provide a chance to confirm their willingness to take on this role. An open dialogue guarantees agreement, strengthens trust, and accurately reflects your wishes. Engaging in this honest conversation fosters a supportive environment where all parties feel comfortable and respected in relation to your decisions.

Understanding Your Rights and Responsibilities

Unlike typical legal arrangements, a Lasting Power of Attorney (LPA) in Singapore gives you immense control over whom you want to represent your interests. With this document, you have the right to make informed decisions about your own future. As the donor, you can specify the types of decisions you want your recipient to handle, granting you the freedom to limit their power as per your comfort level. This can provide you with quite a bit of peace of mind, knowing that you have tailored the arrangement to suit your needs.

Rights of the Donor

Rights to maintain your autonomy and dignity are paramount in an LPA. You retain the right to revoke or modify the agreement whenever you wish, as long as you are mentally capable of doing so. This flexibility empowers you to feel secure while designating someone to manage your affairs during times you may not be able to do so yourself.

Additionally, you have the right to select one or multiple donors, depending on what you find most effective for your situation. You can also stipulate instructions or limitations on the authority you grant, ensuring that your preferences are respected and adhered to throughout the duration of the LPA.

Responsibilities of the Doer

The Donee is entrusted with significant responsibility, which is to act in your best interest at all times. This means they must make decisions that align with your wishes, values, and preferences, ensuring that your needs are prioritised over any personal motives. The donor is also obligated to keep accurate records, making transparency a priority while managing your affairs.

Furthermore, a doneee must also understand that they carry a legal obligation to act with due diligence and care. It’s imperative that they are aware of the financial and emotional responsibilities that come with this role, as any negligence can have serious repercussions for you as the donor.

Limiting Donee Powers: What You Can Do

Against common misconceptions, you have the power to limit the scope of authority granted to your donee. When you create your LPA, you can specify the types of decisions they can make and outline clear boundaries to ensure your wishes are followed. This action allows you to maintain a level of control over your affairs while still having someone manage them should the need arise.

Consequently, it is advisable to clearly articulate any restrictions you want in place when appointing your Donee; this can involve specifying conditions under which they can act or even listing particular areas where you do not want them to step in. This level of specification adds an extra layer of security and assurance that your preferences remain paramount.

The Role of the LPA Certificate Issuer

Now, you might be wondering what exactly the role of an LPA Certificate Issuer is in the process of setting up your Lasting Power of Attorney (LPA) in Singapore. Essentially, the certificate issuer acts as an important checkpoint in ensuring that you understand the implications of creating an LPA. This professional is responsible for certifying that you are making the LPA voluntarily and that you have the mental capacity to do so. They are there to safeguard your interests and provide you with guidance through the process.

Who is a Certificate Issuer?

To put it simply, a certificate issuer is a qualified individual or professional who plays a key role in the LPA process. They can be a lawyer, a medical practitioner, or a social worker registered with the Ministry of Social and Family Development (MSF) in Singapore. Their main duty is to meet with you to discuss your intentions and to ensure you are comfortable with appointing your doer (the person you trust to act on your behalf). This not only reassures you but also helps prevent potential abuse of the LPA.

How to Find a Qualified LPA Certificate Issuer

By searching for a qualified LPA Certificate Issuer, you can ensure that your experience is smooth and straightforward. You can start by checking the official list provided by the MSF, which includes individuals who are certified to issue LPAs. Additionally, seeking recommendations from friends or family who have undergone the same process can be beneficial. Make sure to ask about their experiences and whether they felt comfortable with their chosen issuer, as this can help you make an informed decision.

In addition, you might want to consider reaching out to local law firms or social service agencies, as many of them offer services related to the LPA process. You can also find various online platforms specifically customised to assist individuals like yourself in locating certified LPA Certificate Issuers in your area. A little research can go a long way in helping you find a trusted individual.

Fees and Charges Associated with Certification

Against the common belief that certifying an LPA is without cost, there are indeed fees and charges associated with the certification process. These costs may vary depending on the professional you choose as your certificate issuer, whether it’s a lawyer or a medical practitioner. It’s wise to enquire about these fees upfront so that you’re not caught off guard later in the process. This way, you can better manage your budget and allocate funds for your LPA application.

Qualified professionals might also provide structured fee packages, which can sometimes save you money compared to hourly rates. Some social service agencies may offer reduced fees or even provide certification at no cost if you meet specific eligibility requirements. So make sure to explore all your options to ensure you’re getting the best value for your investment in this important legal document.

Registering Your LPA

Once again, you’re taking an important step in your future by registering your Lasting Power of Attorney (LPA). This process is necessary for ensuring that your chosen Donee has the authority to make decisions on your behalf should the need arise. The registration of your LPA solidifies the legal standing of the document and communicates your wishes clearly, paving the way for a smoother experience for you and your loved ones.

The Registration Process Explained

About the registration process, it begins once you have completed your LPA application. You’ll need to submit it to the Office of the Public Guardian (OPG), either online or by mail. If you choose to submit online, you will need to visit the OPG’s official portal, where you can upload your documents conveniently. Alternatively, if you opted for a paper submission, ensure all necessary signatures are in place before sending your application to the right office.

The OPG will review your application to make sure everything is in order. If all is well, they will register your LPA and send you a confirmation of the registration. This entire process involves some checks to ensure that your application follows the legal requirements, which is all part of safeguarding your rights and choices.

Timeline: How Long Does It Take?

Registration usually takes about 4 to 6 weeks from the time your application is received by the OPG. This timeframe may vary depending on the volume of applications and whether any additional information is required from you. Therefore, it’s advisable to have your application as thorough as possible to facilitate a smooth process.

It’s good practice to keep track of your submission via the portal or any reference number provided to you. This way, you can stay updated regarding the status of your application and ensure that you aren’t left wondering about the progress of your LPA registration.

What Happens After Registration?

Before your LPA is officially registered, you can expect to receive a confirmation letter. Once it’s registered, your Donee can begin making decisions on your behalf according to the instructions laid out in your LPA. With this legal backing, you can have peace of mind knowing that your interests will be protected in the event that you are no longer able to make decisions for yourself.

Indeed, it’s important to keep your recipient informed about your preferences and the scope of their authority outlined in the LPA. They should feel confident in making decisions that align with your wishes. Regular communication with your donor can also help avoid any misunderstandings down the line, ensuring that your intentions are honoured as you envisioned.

Common Myths and Misconceptions

For many people, the concept of a Lasting Power of Attorney (LPA) can be confusing, often leading to a myriad of myths and misconceptions. Understanding the truth behind these can empower you to make informed decisions about your future. Arm yourself with facts, and you’ll see that an LPA is not as daunting as it appears.

Myth vs. Fact: LPA Edition

Myths regarding the LPA often suggest that only the elderly or those in poor health should consider setting one up. In fact, anyone aged 21 or above, regardless of their current health status, can and should consider establishing an LPA. By doing so, you ensure that your personal and financial affairs are managed by someone you trust, no matter what the future holds.

Another common misconception is that appointing a donee with an LPA means you lose control over your decisions. This is far from the truth; you retain full autonomy until you are no longer capable of making informed decisions. Your Donee is there to support you when you need it most, not to take over your life.

The Difference Between LPA and Will

To clarify the distinction between an LPA and a will, it’s crucial to recognise that they serve different purposes. An LPA is designed to allow a trusted person, your Donee, to make decisions on your behalf when you are unable to do so due to mental incapacity. In contrast, a will comes into effect after your passing, directing how your assets should be distributed among your beneficiaries.

Plus, the LPA specifically addresses the management of your affairs during your lifetime. This proactive approach ensures that your wishes are followed while you are still alive. Wills, on the other hand, deal with the assets and obligations that arise after you have passed away. This fundamental difference highlights the importance of having both documents in place to safeguard your interests throughout your life and beyond.

Misunderstandings About Mental Capacity

Differences in understanding mental capacity can lead to unnecessary fears about the LPA process. Many believe they must be diagnosed with a loss of mental capability before they can set up an LPA. However, the truth is that you can establish an LPA while fully capable of making your own decisions. It’s about preparing for all potential scenarios and ensuring your preferences are respected should a time come when you cannot advocate for yourself.

Hence, setting up an LPA is not just a safety net for those with existing cognitive issues; it is a wise decision for anyone who wishes to secure their future. Establishing this document while you are mentally fit provides peace of mind and ensures your choices are in the hands of someone trustworthy if needed.

Final Thoughts and Recommendations

Remember, a Lasting Power of Attorney (LPA) necessitates ongoing attention to ensure its continued suitability for your needs. You will want to review your LPA regularly to adapt to any changes in your life situation or relationships. Here are some tips for reviewing your LPA regularly:

Tips for Reviewing Your LPA Regularly

- Evaluate life changes such as marriage, divorce, or having children.

- Consider changes in health that may affect your mental capacity.

- Assess whether your chosen Donee is still the right person to make decisions on your behalf.

- Reflect on any changes in your financial situation or assets.

Recognising these factors can help you maintain a relevant and effective LPA that aligns with your current circumstances.

When to Update Your LPA

Update your LPA whenever there are significant changes in your life. This could mean re-evaluating your chosen nominee, modifying the powers granted to them, or even revoking the LPA entirely if circumstances warrant it. It’s a good idea to revisit your LPA at least every few years or whenever you experience milestones or shifts in your life.

Reviewing your LPA periodically ensures that it reflects your current wishes and that the person you’ve designated to act on your behalf remains suitable for the role. This proactive approach helps avoid confusion or complications in the future.

Encouraging Open Conversations About LPA

Encouraging open conversations about your LPA with your family and loved ones can lead to a clearer understanding of your wishes. Discussing the topic may help reduce potential conflicts and miscommunications when the time comes for your Donee to step in. You should approach this conversation in a comfortable and informal setting to alleviate any apprehension they may feel.

For instance, consider bringing it up during family gatherings or casual catch-ups. You can share your thoughts about why you’ve set up an LPA and the importance of having everything in place. This openness fosters understanding and strengthens trust between you and your chosen recipient.

FAQ

Q: What is a Lasting Power of Attorney (LPA) in Singapore?

A Lasting Power of Attorney (LPA) is a legal document that allows an individual, known as the ‘Donor’, who is at least 21 years old, to appoint one or more trusted individuals as ‘Donees’. These Donees are granted the authority to make decisions and act on behalf of the Donor in the event that they lose mental capacity. The LPA is designed to ensure that the donor’s wishes are respected and upheld when they are no longer able to make decisions themselves.

Q: How do I go about making an LPA in Singapore?

A: To create a lasting power of attorney in Singapore, you should start by choosing your nominee(s) wisely. Next, you can initiate the application online via the official government portal. After filling out the necessary forms, you will need to find an LPA Certificate Issuer—a trained professional—who can certify that you understand the implications of the LPA. Finally, you must register your completed LPA with the Office of the Public Guardian to ensure its legal standing.

Q: Who can be appointed as a Donee in an LPA?

A donee can be any individual whom you trust to manage your affairs when you lose mental capacity. This could be a family member, a friend, or a professional caregiver. However, it is important to ensure that your nominee is at least 21 years of age and capable of understanding the responsibilities associated with the role. You can also appoint multiple Donees to work together or designate different Donees for specific areas of decision-making.

Q: What decisions can my Donee make on my behalf?

A: The decisions your Donee can make on your behalf depend on the type of authority granted in the LPA. Generally, Donees can make choices related to your personal welfare, such as medical treatment and living arrangements, or manage your financial affairs, including managing bank accounts and property. It is vital to specify the scope of authority clearly in the LPA to ensure that your wishes are followed accurately.

Q: What happens if I change my mind about my LPA or my donee?

If you decide to change your mind about your lasting power of attorney or wish to appoint a different nominee, you have the option to revoke your existing LPA. To do this, you must complete a specific revocation form and notify your donor(s) and the Office of the Public Guardian. It is advisable to create a new LPA that outlines your updated appointments and decisions. Ensure that any changes are made while you still have mental capacity, as once capacity is lost, the existing LPA remains in effect unless formally revoked.