Many of you may be interested in upgrading your banking experience to the OCBC Premier Banking level. This exclusive service offers a range of benefits, from personalised wealth management to priority banking services. To apply for OCBC Premier Banking Privileges, you need to meet certain eligibility criteria and follow a simple application process. In this guide, we will walk you through the steps to help you elevate your banking experience with OCBC Premier Banking.

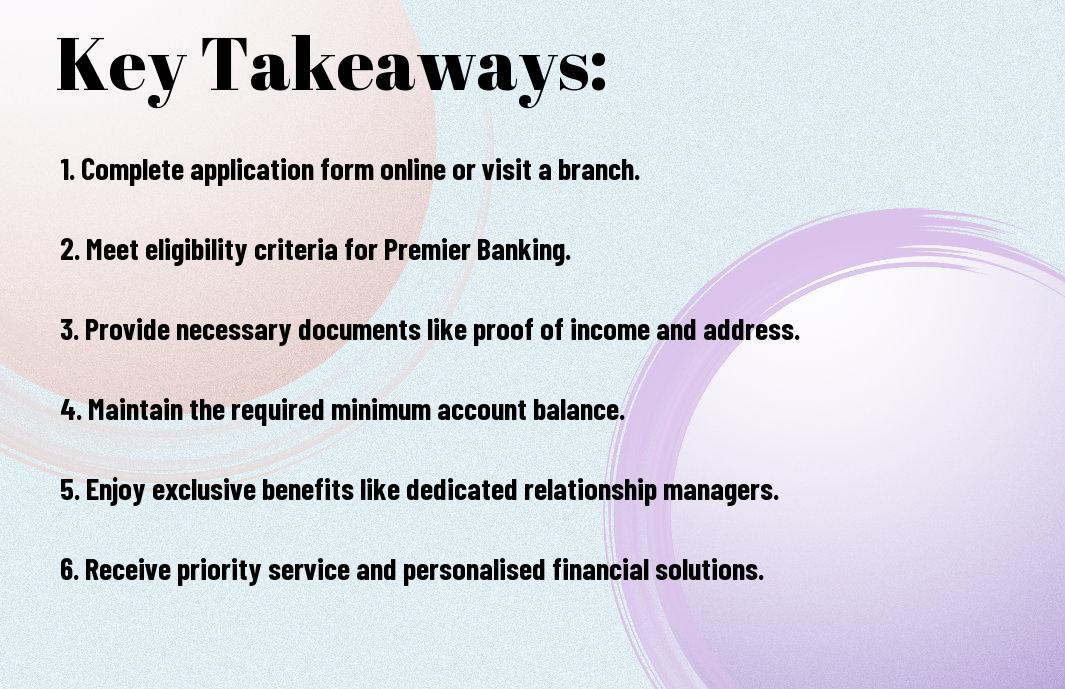

Key Takeaways:

- OCBC Premier Banking: Dive into the world of premier banking with OCBC and enjoy exclusive privileges and personalised services.

- Application Process: Follow a simple and straightforward process to apply for OCBC Premier Banking privileges and elevate your banking experience.

- Eligibility Criteria: Ensure you meet the eligibility criteria set by OCBC to qualify for premier banking benefits.

- Required Documents: Gather the necessary documents, such as identification and financial statements, to complete your application seamlessly.

- Benefits and Perks: Discover the array of benefits and perks that come with being an OCBC Premier Banking customer, from dedicated relationship managers to exclusive events and offerings.

Eligibility Criteria

The OCBC Premier Banking Privileges come with certain eligibility criteria that you need to meet in order to enjoy its benefits. This section outlines the key requirements for individuals seeking to apply for OCBC Premier Banking.

Income Requirements

On your journey to become an OCBC Premier Banking client, one of the crucial factors is meeting the income requirements. To qualify for this exclusive service, you must have a minimum annual income of £120,000 or maintain a minimum of £250,000 in deposits and investments with OCBC Bank.

Keep in mind, these income requirements are in place to ensure that OCBC Premier Banking caters to individuals with a certain level of financial stability and resources. By meeting these criteria, you demonstrate your financial capability and commitment to enjoying the premium banking experience.

Meeting the income requirements is a significant step towards unlocking the exclusive benefits and privileges that OCBC Premier Banking has to offer. It not only showcases your financial standing but also opens the doors to a range of tailored services designed to enhance your banking experience.

Employment Status

Eligibility for OCBC Premier Banking also takes into account your employment status. Whether you are a salaried individual, self-employed, or a professional, your employment status plays a key role in determining your eligibility for this premium banking service.

This factor is crucial, as it helps OCBC Bank assess your financial stability and ability to maintain the required deposit and investment levels. Your employment status provides insights into your income stability and financial commitments, ensuring that you can make the most of the exclusive privileges available to OCBC Premier Banking clients.

Eligibility based on your employment status is necessary to ensure that OCBC Premier Banking is tailored to individuals who can benefit from its premium services and personalised offerings. By meeting the criteria related to your employment status, you position yourself to enjoy a banking experience that aligns with your financial goals and aspirations.

Benefits of OCBC Premier Banking

Some of the benefits of being an OCBC Premier Banking customer are truly exclusive to elevate your banking experience. Unlock a world of Exclusive Privileges that cater to your financial needs and lifestyle. With personalised wealth management solutions, priority banking services, and preferential rates, you can enjoy a bespoke banking experience tailored just for you.

Exclusive Privileges

Any discerning individual like yourself values exclusivity, and OCBC Premier Banking delivers precisely that. Gain access to exclusive investment opportunities, dedicated relationship managers, and curated lifestyle privileges. Whether you seek tailored financial advice or personalised banking services, OCBC Premier Banking ensures you receive the attention and care you deserve.

Explore a realm of luxury and convenience with exclusive travel perks, lifestyle rewards, and premium benefits. Indulge in a world of exclusivity that celebrates your success and provides you with unparalleled advantages that make everyday banking a delightful experience.

Enhanced Services

Enhance every aspect of your banking journey with Enhanced Services that go beyond traditional banking offerings. From priority queue at branches to tailored financial solutions, OCBC Premier Banking ensures that your banking needs are met with precision and excellence. Experience banking like never before with superior service quality that caters to your every need.

Benefits of Enhanced Services include 24/7 dedicated customer support for any urgent banking requirements, preferential rates on wealth management products, and invitations to exclusive events tailored to your interests. Allow OCBC Premier Banking to elevate your banking experience and provide you with exceptional services that cater to your unique financial goals.

Understanding Enhanced Services

Benefits of Enhanced Services encompass a wide range of offerings designed to elevate your banking experience. From tailored financial solutions to premium customer support, OCBC Premier Banking ensures that you receive the best-in-class services that align with your financial aspirations. Experience the true essence of luxury banking with OCBC Premier Banking today.

Application Process

Online Application

Online, you can easily apply for OCBC Premier Banking Privileges by visiting the official website and filling out the application form. Make sure to have all your necessary documents prepared, such as proof of identification, address, and income. This step is crucial, as any missing information can delay the processing of your application. Once you have completed the form, double-check all details for accuracy before submitting.

After you submit your online application, the bank will review your information. If everything is in order, you will receive further instructions via email on the next steps to finalise your application. This may include scheduling an appointment for a video call or providing additional documents for verification. Be prompt in responding to any requests to avoid any delays in the process.

Upon successful verification and approval, you will receive confirmation of your new OCBC Premier Banking status. You can then enjoy exclusive privileges and benefits tailored to your financial needs. Remember to set up your online banking access and explore all the features available to you as a Premier Banking customer.

In-Person Application

Process your application in person by visiting your nearest OCBC branch. The dedicated staff will assist you in filling out the necessary forms and guide you through the application process. It is crucial to bring all required documents for verification to prevent any delays in your application.

With in-person applications, you have the advantage of receiving immediate feedback on your application status. The staff can address any queries you may have on the spot and provide clarity on the documentation required. This personalised approach ensures a smoother application process and allows for real-time assistance.

With a face-to-face application, you can also discuss your financial goals and preferences directly with the banking professionals. They can offer tailored advice and recommend suitable products and services that align with your needs. This personalised touch is one of the key benefits of opting for an in-person application for your Premier Banking privileges.

Required Documents

Not everyone can access OCBC Premier Banking privileges. To enjoy the exclusive benefits, you need to submit specific documents that verify your identity and financial standing. Let’s start by looking at the identification documents required.

Identification Documents

To initiate your OCBC Premier Banking application, you must provide identification documents. These typically include your passport, national identity card, or driver’s licence. Make sure these documents are valid and not expired. This validation step is crucial for security purposes and ensures that you are the rightful account holder.

Furthermore, you may be asked to submit proof of your residential address. This can be a recent utility bill or a bank statement with your name and address clearly displayed. Remember to keep these documents handy to avoid any delays in the application process. Accuracy and completeness in submitting these documents will help smooth your transition into OCBC Premier Banking.

Understanding the importance of providing accurate identification documents is key to unlocking the premium services of OCBC Premier Banking. By adhering to these requirements, you demonstrate your commitment to maintaining a secure and efficient banking relationship with OCBC.

Income Proof

To further support your application, you are also required to furnish income proof. This may include recent payslips, tax assessments, or bank statements reflecting your income sources. Ensuring the authenticity of these documents is vital to showcasing your financial stability and ability to meet the eligibility criteria for OCBC Premier Banking.

Any discrepancies or inconsistencies in the income proof provided may raise red flags during the verification process. It is advisable to provide clear and transparent documentation to strengthen your application and increase your chances of approval. OCBC Premier Banking privileges are reserved for individuals who meet the stringent financial requirements, and accurate income proof plays a significant role in this assessment.

Account Opening Process

All set to elevate your banking experience with OCBC Premier Banking? Let’s get you started on the account opening process. You must feel excited about the exclusive privileges that await you!

Initial Deposit

Process your application by ensuring you have the required initial deposit amount ready in your account. This is the first step towards unlocking a world of bespoke financial services tailored to meet your needs. Do not forget, this initial deposit signifies your commitment to embracing the superior benefits of OCBC Premier Banking.

With OCBC Premier Banking, your initial deposit not only kickstarts your journey but also sets the tone for a sophisticated banking relationship that prioritises your financial goals and aspirations. So, make sure you’re well-prepared to make this first important move towards enjoying a new level of banking excellence.

Account Activation

Any final hurdles? Not quite yet. After your application is processed, you’ll receive detailed instructions on how to activate your OCBC Premier Banking account. This step is crucial to officially unlocking all the tailored benefits and services that come with being a Premier Banking member.

With OCBC Premier Banking, activating your account signals the beginning of a seamless banking experience designed exclusively for you. From personalised financial advice to priority services, you’re now on your way to experiencing first-class banking like never before.

OCBC Premier Banking Tiers

Premier Banking Privileges

Your journey with OCBC Premier Banking Privileges begins here. As you step into the world of premier banking, you open the door to a range of exclusive benefits tailored to enhance your banking experience. Enjoy priority queueing at branches, access to dedicated relationship managers who provide personalised financial advice, and a suite of premium banking products designed to meet your wealth management needs.

Premier Private Client

OCBC elevates your banking experience to new heights with Premier Private Client status. As a Premier Private Client, you gain access to a bespoke suite of wealth management services crafted to align with your financial goals and aspirations. Experience exclusive invitations to high-profile events, tailored financial planning strategies, and priority access to a wide range of investment opportunities to grow your wealth portfolio.

A Premier Private Client status with OCBC is a testament to your financial success and opens the doors to a world of exclusive privileges reserved for a select few. Enjoy tailored wealth solutions, dedicated support from a team of experts, and priority banking services that cater to your every financial need. Elevate your banking experience with OCBC Premier Private Client status today.

Fees and Charges

Monthly Fees

To start your journey with OCBC Premier Banking Privileges, you will need to be aware of the monthly fees that apply. These fees are a key consideration as you enjoy the exclusive benefits that come with being a Premier Banking customer. The monthly fees are designed to ensure that you receive top-notch service and access to a range of wealth management tools and services. Rest assured that these fees are transparent and help maintain the high level of personalised service that OCBC is known for.

Transaction Fees

Monthly, you may encounter transaction fees as you manage your finances with OCBC Premier Banking. It’s important to be aware of these fees and how they may impact your banking experience. Whether you are making local or international transactions, transfers, or payments, there may be associated fees. However, these fees are in place to ensure the smooth processing of your financial transactions and to provide you with peace of mind that your banking needs are being taken care of efficiently.

Another point to note about transaction fees is that OCBC Premier Banking offers competitive rates compared to other financial institutions. By understanding the transaction fees, you can make informed decisions about your banking activities and maximise the benefits of being a Premier Banking customer. Note, these fees contribute to the exceptional service and comprehensive financial solutions that OCBC provides to its esteemed clients.

Credit Card Options

Despite the various credit card options available in the market, choosing the right one can be overwhelming. With OCBC Premier Banking privileges, you have access to exclusive credit card choices that offer a host of benefits tailored to your lifestyle and needs. Let’s explore two of the top credit card options within the OCBC Premier Banking suite.

OCBC Premier Visa Infinite Card

With the OCBC Premier Visa Infinite Card, you can enjoy a world of luxury and convenience at your fingertips. This prestigious card offers you unlimited access to airport lounges worldwide, making your travel experience truly seamless. Furthermore, you can benefit from exclusive dining privileges at top restaurants and enjoy complimentary travel insurance coverage when you charge your travel tickets to the card.

For a discerning individual like yourself, the OCBC Premier Visa Infinite Card is the epitome of sophistication and convenience. The exceptional rewards programme allows you to earn air miles, cash rebates, and more every time you make a purchase. Additionally, the card offers 24/7 dedicated concierge service to assist you with reservations, travel arrangements, and any other requests you may have.

OCBC Premier American Express Card

Credit is the key to unlocking a world of privileges with the OCBC Premier American Express Card. This card is designed to cater to your discerning taste and lifestyle, offering a range of benefits that enhance your overall banking experience. Enjoy exclusive discounts at select merchants, complimentary access to luxurious airport lounges, and special privileges when you dine at partner restaurants.

For instance, the OCBC Premier American Express Card provides you with priority pass privileges, allowing you to breeze through airport security and immigration queues. Additionally, you can take advantage of 24-hour concierge services to assist you with travel arrangements, reservations, and even gift deliveries. This card truly exemplifies luxury and convenience tailored to your needs.

Investment Opportunities

Unit Trusts

After securing your OCBC Premier Banking privileges, you may be looking for ways to grow your wealth. One popular option is investing in Unit Trusts. These are professionally managed funds that pool money from multiple investors to invest in a diversified portfolio of assets. By investing in Unit Trusts, you can access a wide range of markets and sectors without the need to pick individual stocks or bonds. This can help spread your risk and potentially increase your returns over the long term. As a Premier Banking client, you can benefit from exclusive access to a curated selection of Unit Trusts tailored to your risk profile and investment goals.

Bonds and Fixed Income

The world of Bonds and Fixed Income offers another avenue for you to explore as an OCBC Premier Banking client. Fixed-income investments offer consistent interest payments over a predetermined time period, whereas bonds are debt securities that governments or corporations issue. Investing in Bonds can provide a steady income stream and diversification in your investment portfolio. With your Premier Banking status, you can access a range of Bond offerings with various credit ratings and yields. This allows you to tailor your fixed-income investments to suit your risk tolerance and financial objectives.

To further enhance your understanding of bonds and fixed-income investments, consider diversifying your portfolio across different bond issuers, industries, and maturity dates. By spreading your investments, you can reduce the impact of any single bond default and potentially enhance your overall returns. Keep in mind that bonds and fixed-income products are not risk-free, and fluctuations in interest rates can affect their market value. As a Premier Banking client, you can leverage the expertise of your Relationship Manager to navigate the complexities of Bond investing and design a well-rounded investment strategy.

Insurance Solutions

Keep your loved ones protected and secure with comprehensive life insurance solutions from OCBC Premier Banking. To ensure that your family is financially stable in times of need, you can choose from a range of tailored policies that suit your unique requirements. Whether you’re looking to provide for your children’s education or safeguard your family’s future, our dedicated team of experts will guide you through the process and help you select the most suitable plan.

Life Insurance

On your journey towards securing your financial future, investing in a reliable life insurance plan is crucial. With OCBC Premier Banking, you can rest assured that your loved ones will be taken care of in the event of unforeseen circumstances. By opting for our life insurance policies, you are not just buying a plan; you are investing in peace of mind, knowing that your family’s well-being is our top priority.

General insurance also plays a significant role in safeguarding your assets and providing protection against unexpected events. At OCBC Premier Banking, our range of general insurance products covers everything from home and car to travel and personal accident insurance. By opting for our general insurance solutions, you can enjoy peace of mind knowing that your valuable possessions are well-protected, allowing you to focus on what truly matters in life.

Wealth Management Services

Now, let’s examine into the wealth management services offered by OCBC Premier Banking. As far as financial planning,

Financial Planning

is a key aspect of securing your future. With OCBC Premier Banking, you will have access to a team of experienced financial advisors who will work closely with you to understand your financial goals and create a tailored plan to help you achieve them. Whether you are saving for a major purchase, planning for your retirement, or looking to grow your wealth, the team will provide you with expert guidance every step of the way.

Moving on to the

Portfolio Management

service provided by OCBC Premier Banking, this is where the experts take the reins to maximise your investments. The team will carefully assess your risk tolerance, investment objectives, and time horizon to create a personalised investment portfolio that aligns with your financial goals. They will actively manage your portfolio, making strategic adjustments to ensure that it remains in line with market conditions and your investment objectives. This hands-on approach allows you to sit back and relax, knowing that your investments are in capable hands.

The Portfolio Management service not only aims to grow your wealth but also to protect it. The team will continuously monitor the performance of your investments and make timely decisions to mitigate risks and capitalise on opportunities. With OCBC Premier Banking by your side, you can rest assured that your financial future is in safe hands. management of your portfolio will be conducted with the utmost care and expertise, giving you peace of mind knowing that your assets are being managed by professionals who have your best interests at heart.

It’s crucial to entrust your financial future to a reputable and experienced team that can help you navigate the complexities of wealth management. With OCBC Premier Banking’s wealth management services, you can take a proactive approach to securing your financial future and achieving your long-term financial goals. Whether you are looking to grow your wealth, plan for retirement, or protect your assets, OCBC Premier Banking offers a comprehensive suite of services to help you every step of the way. By tapping into their expertise and guidance, you can rest easy, knowing that your financial well-being is in good hands.

Premium Services

Once again, OCBC impresses with its array of premium services tailored to provide you with an unparalleled banking experience. From dedicated relationship managers to priority banking privileges, your financial needs are meticulously catered to.

Dedicated Relationship Manager

The key to unlocking exclusive banking services lies in having a dedicated relationship manager who is attuned to your every financial need. Your relationship manager will serve as your trusted advisor, offering bespoke solutions that align with your goals and aspirations. Whether you need assistance with wealth management, investments, or simply have a banking query, your relationship manager is there to provide you with personalised assistance.

With a dedicated relationship manager, you can rest assured that you are receiving tailored financial advice that is in line with your unique circumstances. From streamlining your financial portfolio to maximising your investment potential, your relationship manager is committed to helping you achieve financial success.

Priority Banking

Dedicated to offering you a banking service that prioritises your needs, OCBC’s Priority Banking is designed to elevate your banking experience. As a Priority Banking customer, you gain access to a host of exclusive privileges, including preferential pricing, priority queue at branches, and premium banking services that cater to your every need.

With Priority Banking, you can enjoy enhanced convenience and efficiency in managing your finances. Whether you require assistance with your account, investments, or any other banking service, your Priority Banking status ensures that you receive first-class support at all times.

Common Application Mistakes

Incomplete Documents

Unlike a half-baked cake, submitting your application with incomplete documents won’t get you anywhere. Missing crucial paperwork can significantly delay the processing of your OCBC Premier Banking privileges application. Make sure you have all the required documents, such as proof of income, identification, and address verification, ready when you submit your application. Don’t let a missing piece of paper stand between you and your exclusive banking benefits.

Incorrect Information

Information is power, but only when it’s correct. Providing incorrect information on your application can lead to complications down the line. Double-check all the details you provide, from your personal information to your financial details. The smallest mistake, such as a typo in your address or a wrong digit in your income, could cause your application to be rejected or delayed. Take the time to review your application thoroughly before submitting it.

Incomplete information also includes failing to disclose all your assets or liabilities. Be transparent about your financial standing to ensure a smooth application process. Keep in mind, the more accurate and complete your information, the faster you can enjoy the privileges of being an OCBC Premier Banking member. Make sure to fill in all the required fields and provide any additional documents promptly to avoid any hiccups in your application process.

Final Words

To wrap up, applying for OCBC Premier Banking Privileges is a straightforward process that can elevate your banking experience to a whole new level. By meeting the eligibility criteria, submitting the required documents, and opening a Premier Banking account, you can enjoy exclusive benefits and personalised services tailored to meet your financial needs. Remember to maintain the minimum balance to continue enjoying these benefits.

Once you have successfully applied, you can look forward to priority services, higher interest rates, preferential rates on loans, and access to luxurious banking lounges. Investing in your financial well-being by becoming an OCBC Premier Banking customer not only enhances your banking experience but also shows that you value premium services and benefits that cater to your lifestyle and financial goals. Take the first step towards unlocking a world of exclusive privileges with OCBC Premier Banking.

In summarisation, don’t miss out on the opportunity to elevate your banking experience. Start your journey by applying for OCBC Premier Banking Privileges today. Enjoy the perks, convenience, and personalised services designed to cater to your unique needs. Make a smart choice for your financial future and experience banking at its finest with OCBC Premier Banking.

FAQ

Q: Who is eligible to apply for OCBC Premier Banking Privileges?

A: To be eligible for OCBC Premier Banking Privileges, you need to maintain a minimum of £50,000 or its equivalent in your OCBC deposit accounts, investments, or insurance with the bank.

Q: What are the benefits of OCBC Premier Banking?

A: OCBC Premier Banking offers a range of exclusive benefits, such as dedicated relationship managers, priority queue at branches, access to investment opportunities, preferential rates on loans, and more.

Q: How can I apply for OCBC Premier Banking Privileges?

A: To apply for OCBC Premier Banking Privileges, simply visit the nearest OCBC branch or contact the bank’s customer service to schedule an appointment with a relationship manager who will guide you through the application process.

Q: What documents do I need to prepare for the OCBC Premier Banking application?

A: You will typically need to provide identification documents, proof of address, proof of income, as well as details of your assets and liabilities for the application process. Your relationship manager will advise you on the specific requirements.

Q: How long does it take for the OCBC Premier Banking application to be processed?

A: The processing time for OCBC Premier Banking applications may vary, but your relationship manager will strive to assist you promptly and keep you informed throughout the application process, ensuring a smooth and efficient experience.