Over the years, the landscape of personal finance has evolved, and managing your finances efficiently has become more crucial than ever. With the UOB EVOL Card’s innovative financial management tools, you can take control of your expenses, track your spending patterns, and make informed decisions about your money. These tools not only help you budget effectively but also provide insights into your financial habits, helping you save and invest wisely for the future. Embrace the future of personal finance with UOB EVOL Card’s comprehensive financial management tools.

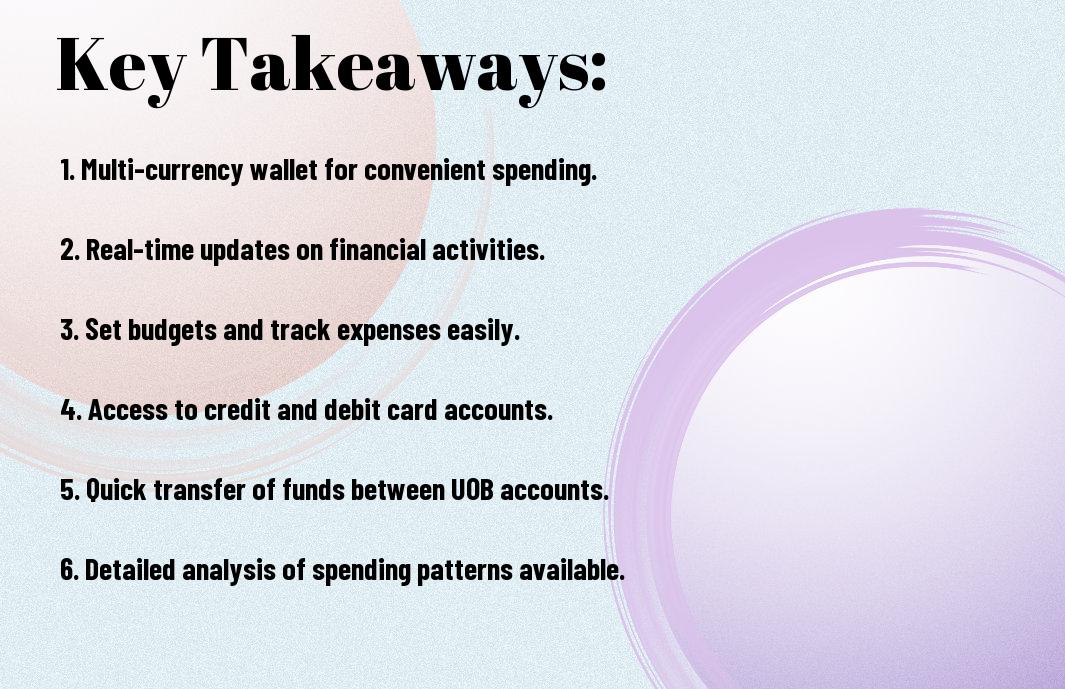

Key Takeaways:

- Personalised Financial Insights: The UOB EVOL Card offers personalised insights into your spending habits and financial health, helping you make informed decisions.

- Budget Tracking Tools: With the card’s budget tracking tools, you can easily monitor and control your spending, ensuring you stay within your financial goals.

- Saving Goals Feature: Set saving goals with the UOB EVOL Card and track your progress, motivating you to save more efficiently towards your financial targets.

- Expense Categorisation: The card automatically categorises your expenses, providing a clear breakdown of where your money is going to help you identify areas for potential savings.

- Smart Notifications: Receive smart notifications on your spending patterns and financial activities, enabling you to stay on top of your finances and make better decisions.

The Evolution of Personal Finance

The Rise of Digital Banking

Digital banking has revolutionised the way you manage your finances. With the advent of online banking platforms and mobile banking apps, you now have access to your accounts and financial transactions at your fingertips. This accessibility not only allows you to check your balances and make payments conveniently but also empowers you to track your expenses in real-time.

Moreover, digital banking offers enhanced security features to safeguard your personal information and financial data. Through encryption technologies and biometric authentication, you can have peace of mind knowing that your transactions are secure. The convenience and security of digital banking have made traditional brick-and-mortar banking seem outdated in comparison.

As you embrace the digital age of banking, you are presented with a myriad of tools and resources to improve your financial management. From budgeting apps to investment platforms, digital banking has democratised access to financial services, empowering you to take charge of your financial future.

The Need for Innovative Financial Tools

The evolution of personal finance has created a demand for innovative financial tools that cater to your specific needs. In today’s dynamic and fast-paced world, traditional financial products may no longer suffice to help you achieve your financial goals. This is where the UOB EVOL Card’s financial management tools come into play.

By offering features such as real-time spending insights, budget tracking, and goal setting, the UOB EVOL Card empowers you to make informed financial decisions and stay on top of your finances. These innovative tools act as your personal finance assistant, helping you navigate the complexities of money management effortlessly.

With the UOB EVOL Card, you can enjoy the convenience of a credit card combined with the intelligence of advanced financial management tools. This integration allows you to optimise your spending, save more effectively, and work towards your financial aspirations with confidence.

Introducing the UOB EVOL Card

One

A New Era in Financial Management

Financial management is evolving rapidly, and the UOB EVOL Card is at the forefront of this revolution. With advanced features and cutting-edge technology, this card is not just a payment tool; it’s your personal finance assistant. By integrating seamlessly with your smartphone, the UOB EVOL Card offers a new era in financial management, empowering you to take control of your spending, savings, and investments like never before.

Imagine having a virtual financial advisor in your pocket, guiding you on how to budget, where to invest, and how to maximise your savings. With real-time updates and personalised recommendations, the UOB EVOL Card is designed to help you make smarter financial decisions and achieve your money goals with ease.

Take charge of your financial future with the UOB EVOL Card and commence on a journey towards financial wellness and freedom. Embrace the power of technology to streamline your financial management and transform the way you interact with your money.

Key Features and Benefits

To fully grasp the impact of the UOB EVOL Card, let’s research into its key features and benefits:

- Track your spending in real-time to stay within budget.

- Receive personalised insights and recommendations based on your spending habits.

- Set financial goals and monitor your progress effortlessly.

Knowing where your money is going and how you can make it work harder for you is crucial in achieving financial stability and growth. The UOB EVOL Card equips you with the tools to do just that, putting you in the driver’s seat of your financial journey.

More about Key Features and Benefits

EVOL takes your financial management to the next level by offering a range of features that are designed to simplify and enhance your financial life:

- AI-powered financial insights for smarter decisions.

- Automated investment recommendations based on your risk profile and financial goals.

- Integrated budget tracking tools to help you stay on top of your finances effortlessly.

Knowing how to make the most of your money can be challenging, but with the UOB EVOL Card by your side, you can navigate the complexities of personal finance with confidence and ease.

Budgeting Made Easy

Tracking Expenses with Ease

All your financial transactions can be effortlessly tracked with the UOB EVOL Card’s financial management tools. By simply logging into your account, you can categorise and monitor your expenses with just a few clicks. Say goodbye to the stress of manually recording every penny spent; this innovative tool does the hard work for you. Understanding where your money goes has never been simpler.

With the Tracking Expenses feature, you can identify patterns in your spending habits, helping you make more informed decisions. Whether you’re a savvy shopper or a spontaneous spender, this tool provides valuable insights that can guide you towards a more secure financial future. Its user-friendly interface makes it a breeze to navigate, putting you in control of your financial journey.

By having a clear overview of your expenses, you can proactively adjust your budget and ensure you’re on the right track to meet your financial goals. The convenience and simplicity of the UOB EVOL Card’s expense tracking feature empower you to take charge of your financial well-being like never before.

Setting Financial Goals and Alerts

An important part of managing your finances effectively is setting achievable financial goals. With the UOB EVOL Card, you can set specific targets, whether it’s saving for a dream holiday or establishing an emergency fund. The Setting Financial Goals feature allows you to track your progress and stay motivated on your financial journey.

Furthermore, the Setting Financial Goals function enables you to set customised alerts to keep you on track. Whether it’s reaching a savings milestone or staying within your monthly budget, these personalised alerts help you stay disciplined and focused on your financial objectives. By receiving notifications that align with your goals, you can make informed decisions that move you closer to financial success.

With the UOB EVOL Card’s innovative tools, you can create a financial roadmap that suits your lifestyle and aspirations. These features provide a structured yet flexible approach to managing your money, offering you the support and guidance you need to achieve your financial dreams.

Expense Management

Not only does the UOB EVOL Card offer you a range of features to help manage your expenses effectively, but it also provides powerful tools for categorising and analysing your spending habits. By utilising these tools, you can gain valuable insights into where your money is going each month.

Categorising and Analysing Spending

Categorising your expenses allows you to see exactly how much you’re spending on different categories, such as groceries, dining out, entertainment, and more. This feature not only helps you identify patterns in your spending but also enables you to set budgets for each category. By analysing your spending in detail, you can pinpoint areas where you may be overspending and make adjustments to your budget accordingly.

Identifying Areas for Improvement

Categorising your expenses is just the first step in effectively managing your finances. The UOB EVOL Card goes a step further by helping you identify areas for improvement. By highlighting categories where you consistently overspend, the card’s financial management tools empower you to make positive changes to your spending habits. This proactive approach to financial management can help you save more, invest wisely, and ultimately achieve your financial goals sooner.

Analysing your spending patterns with the UOB EVOL Card’s tools not only gives you a better understanding of your financial habits but also equips you with the knowledge to make informed decisions about your money. By taking control of your expenses and actively working towards improving your financial health, you are setting yourself up for a more secure and stable financial future.

Credit Score Monitoring

After you have examined into personal finance with the UOB EVOL Card, it’s important to understand the significant role that credit scores play in your financial life.

The Importance of Credit Scores

The way you manage your credit directly impacts your credit score, which is a numerical representation of your creditworthiness. Lenders use this score to determine whether to approve your loan applications and what interest rates to offer you. A good credit score can open doors to better financial opportunities, while a poor one can limit your options.

Monitoring your credit score is crucial as it allows you to track your financial health and detect any discrepancies or fraudulent activities that could harm your credit profile. By staying updated on your credit score, you can take proactive steps to improve it over time. A good credit score not only gives you access to favourable loan terms but also reflects your responsible financial behaviour.

How the UOB EVOL Card Can Help

ScoresThe UOB EVOL Card provides an array of financial management tools that can assist you in monitoring and improving your credit score. By leveraging the card’s features such as real-time expense tracking, budget categorisation, and spending analysis, you can gain valuable insights into your spending patterns and payment habits. This visibility can help you make informed decisions to manage your finances better and ultimately boost your credit score.

Moreover, the UOB EVOL Card offers credit score monitoring as part of its suite of financial management tools. This feature allows you to regularly check your credit score through the UOB mobile app, keeping you informed about any fluctuations and enabling you to take timely actions to protect or enhance your creditworthiness. By having easy access to your credit score, you can actively work towards maintaining a healthy financial profile. Importance

It’s empowering to have a tool like the UOB EVOL Card at your disposal, helping you stay on top of your credit score and overall financial well-being. By utilising the card’s resources effectively, you can cultivate good financial habits and secure a more stable financial future for yourself.

Investment Opportunities

Diversifying Your Portfolio

All investment comes with a level of risk, and it is crucial to diversify your portfolio to protect yourself against potential financial losses. By spreading your investments across different asset classes such as stocks, bonds, property, and commodities, you reduce the overall risk in your portfolio. This means that if one investment underperforms, the others can help balance out the losses. With the UOB EVOL Card’s Financial Management Tools, you can easily track and manage your investments across various asset classes, helping you make informed decisions to diversify effectively.

Diversification is not just about owning different investments but also about considering factors like industry sectors, geographical locations, and investment styles. It’s vital to understand the correlation between your investments to ensure that they don’t all move in the same direction during market fluctuations. UOB EVOL Card’s Financial Management Tools provide you with the necessary data and insights to assess correlations and make adjustments to your portfolio accordingly.

Note, while diversification can mitigate risk, it does not guarantee profit or protect against loss in declining markets. It’s crucial to regularly review and rebalance your portfolio to align with your financial goals and risk tolerance. With the UOB EVOL Card’s Financial Management Tools, you have the power to take control of your investments and build a diversified portfolio that suits your needs.

Expert Insights and Recommendations

In terms of investment opportunities, having access to expert insights and recommendations can make a significant difference in your decision-making process. UOB EVOL Card’s Financial Management Tools leverage cutting-edge technology to provide you with expert analysis on market trends, opportunities, and potential risks. This invaluable resource allows you to stay informed and up to date with the latest developments in the financial world.

Experts recommend staying focused on your long-term investment goals and avoiding emotional reactions to short-term market fluctuations. By using the UOB EVOL Card’s Financial Management Tools, you can gain a deeper understanding of your investments’ performance and make decisions based on data rather than emotions. This disciplined approach can help you navigate the complexities of the financial markets with confidence.

Furthermore, experts advise considering your risk tolerance, investment horizon, and financial objectives when making investment decisions. With the UOB EVOL Card’s Financial Management Tools, you can access personalised recommendations tailored to your financial profile, empowering you to build a resilient investment portfolio that aligns with your ambitions for the future.

Savings Strategies

Maximizing Interest Rates

Rates are crucial when it comes to growing your savings. With the UOB EVOL Card’s financial management tools, you can keep track of the latest interest rates offered by different banks. By regularly comparing and moving your savings to accounts with higher interest rates, you can maximise your returns over time.

Furthermore, the card’s tools can help you set up automated transfers to take advantage of promotional rates or switch to accounts offering better returns. This hands-on approach ensures that you are always making the most of your savings and earning the highest possible interest.

By leveraging the UOB EVOL Card’s financial management tools to stay informed and proactive, you can capitalise on changing interest rates and make strategic decisions to boost your savings.

Building an Emergency Fund

One of the key features of the UOB EVOL Card’s financial management tools is the ability to set savings goals, such as building an emergency fund. You can create a specific target amount and track your progress towards achieving it, helping you stay disciplined and focused on your financial objectives.

Having an emergency fund is vital for unexpected expenses or financial setbacks. With the UOB EVOL Card’s tools, you can easily allocate a portion of your income towards this fund and monitor its growth. This proactive approach ensures that you are prepared for any unforeseen circumstances that may arise.

Understanding the importance of building an emergency fund and utilising the UOB EVOL Card’s tools to establish and reach your savings goals will provide you with financial stability and peace of mind for the future.

Debt Management

Despite the challenges you may face in managing your debts, the UOB EVOL Card’s financial management tools are here to help you take control of your finances. With features designed to assist you in making sound financial decisions, you can consolidate your debts and reduce the burden of high-interest rates.

Consolidating Debt and Reducing Interest

With the UOB EVOL Card, you have the option to consolidate multiple debts into one manageable monthly payment. By doing so, you can streamline your finances and potentially reduce the overall interest you pay. This consolidation feature not only simplifies the debt repayment process but also helps you save money in the long run by avoiding excessive interest charges.

Furthermore, the card offers competitive interest rates for balance transfers, allowing you to move high-interest debt from other sources to your UOB EVOL Card. This can be a strategic move to lower your interest payments and accelerate your journey towards becoming debt-free.

Creating a Debt Repayment Plan

Interest in creating a structured debt repayment plan? The UOB EVOL Card’s financial management tools provide you with the resources to do just that. By inputting your debts, income, and expenses into the system, you can generate a personalised repayment plan that fits your budget and timeline.

Another key feature of the UOB EVOL Card is its payment reminder function, which alerts you when your payments are due. This proactive approach helps you stay on track with your debt repayment plan and avoid any missed or late payments that could negatively impact your financial standing.

Security and Protection

Your peace of mind is paramount when it comes to managing your finances. With UOB EVOL Card’s advanced fraud detection measures, you can rest assured that your transactions are being closely monitored for any suspicious activity. This includes real-time alerts for unusual spending patterns or transactions, safeguarding you against potential fraudsters.

Advanced Fraud Detection

The Advanced Fraud Detection feature of the UOB EVOL Card provides an extra layer of security for your financial transactions. Here is a breakdown of how it works:

| Real-time Alerts | Receive immediate notifications for any unusual spending behaviour or transactions on your card. |

| Transaction Monitoring | Your transactions are closely monitored to detect any suspicious activity, protecting you from fraud. |

By leveraging cutting-edge technology, UOB EVOL Card’s Advanced Fraud Detection system helps prevent unauthorised transactions and keeps your financial information safe and secure.

Insurance Coverage and Benefits

With UOB EVOL Card, you can also enjoy a range of insurance coverage and benefits to further protect your financial well-being. This includes comprehensive travel insurance for when you’re on the go, purchase protection for your shopping, and extended warranty on eligible items.

Advanced features such as purchase protection ensure that you are covered in case of damaged or lost items, giving you peace of mind with every purchase you make using your UOB EVOL Card.

Seamless Transactions

Contactless Payments and Mobile Wallets

On the topic of seamless transactions, the UOB EVOL Card offers you the convenience of contactless payments and mobile wallets. Unlike traditional card payments where you need to swipe or insert your card, with contactless payments, you can simply tap your card on the terminal to complete your transaction swiftly. This not only saves you time at the checkout but also provides added security as you remain in control of your card throughout the transaction.

Furthermore, the UOB EVOL Card allows you to digitise your card on your mobile phone, turning it into a mobile wallet. This means you can make payments using just your smartphone, eliminating the need to carry physical cards with you. With your card securely stored on your device, you can enjoy the flexibility of making payments on the go, whether you’re shopping online or in-store.

By embracing contactless payments and mobile wallets, you can experience a shift towards a more efficient and secure way of transacting. With the UOB EVOL Card’s financial management tools, managing your transactions becomes not only convenient but also cutting-edge.

International Transactions and Currency Exchange

Wallets onboard your journey towards seamless transactions, the UOB EVOL Card caters to your international transactions and currency exchange needs. When you make purchases overseas or online in foreign currencies, the card automatically converts the amount to your home currency without any additional hassle. This feature allows you to shop globally without worrying about fluctuating exchange rates.

International transactions can often come with hidden fees and unfavourable exchange rates, but with the UOB EVOL Card, you can enjoy competitive rates and transparent pricing. Whether you’re travelling for business or pleasure, having a card that simplifies your spending abroad can make your overall experience more enjoyable and stress-free.

With the UOB EVOL Card’s focus on seamless and efficient international transactions, you can confidently explore the world knowing that your financial transactions are being handled with the utmost care and convenience.

Personalized Financial Planning

Many financial institutions offer generic financial advice that may not necessarily apply to your specific circumstances. However, with the UOB EVOL Card’s financial management tools, you can benefit from AI-Driven Insights and Recommendations tailored to your unique financial situation. These tools use artificial intelligence algorithms to analyse your spending patterns and offer personalised advice on how you can improve your financial health.

AI-Driven Insights and Recommendations

Any decisions you make regarding your finances can have a significant impact on your future. The AI-driven insights provided by the UOB EVOL Card can help you make informed choices based on your spending habits and financial goals. By using advanced algorithms, the card can identify areas where you may be overspending and suggest adjustments to help you achieve your savings targets.

Customized Budgeting and Savings Plans are another imperative feature of the UOB EVOL Card’s financial management tools. These tools allow you to set specific savings goals and create a budget that aligns with your financial objectives. By customising your budget and savings plans, you can take control of your finances and work towards achieving your long-term financial goals.

Customized Budgeting and Savings Plans

An effective budgeting and savings plan is crucial for achieving financial stability. With the UOB EVOL Card, you can create personalised budgets based on your income and expenses. By setting Plans that are tailored to your financial situation, you can track your progress and make adjustments as needed to ensure you stay on track to meet your financial goals.

Integration and Accessibility

Once again, the UOB EVOL Card sets itself apart with its seamless integration and accessibility features that make managing your finances a breeze. Let’s take a closer look at how the card’s financial management tools are designed to simplify your life.

Mobile App and Online Platform

Accessibility is key when it comes to staying on top of your finances, and the UOB EVOL Card delivers on this front with its user-friendly mobile app and online platform. With just a few taps on your smartphone or clicks on your computer, you can access real-time account information, track your expenses, set budgeting goals, and even receive personalised financial tips. This level of convenience empowers you to take charge of your financial well-being wherever you are, whenever you need.

Multi-Account Management and Aggregation

Aggregation is another standout feature of the UOB EVOL Card, allowing you to view multiple account balances and transactions in one place. Gone are the days of logging in to multiple banking accounts to get a complete picture of your finances. With the UOB EVOL Card, you can centralise all your accounts, whether they are with UOB or other banks, for a holistic view of your financial standing. This not only saves you time but also helps you make more informed decisions about your money.

The Multi-Account Management and Aggregation feature of the UOB EVOL Card demonstrates the card’s commitment to providing you with a comprehensive financial management solution. By bringing together all your accounts in one place, the card simplifies the task of monitoring your finances and enables you to identify any potential issues or opportunities at a glance. This powerful tool empowers you to take control of your financial future with greater ease and confidence.

Customer Support and Education

Dedicated Customer Service

Support is key when it comes to managing your finances effectively, and with the UOB EVOL Card, you can count on dedicated customer service to guide you every step of the way. Whether you have queries about your account, need help with a transaction, or want advice on how to make the most of the card’s features, the friendly and knowledgeable customer service team is there to assist you. With their expertise, you can rest assured that your financial concerns will be addressed promptly and accurately.

Financial Literacy Resources and Workshops

For a deeper understanding of financial management, the UOB EVOL Card offers a range of financial literacy resources and workshops to help you enhance your money management skills. These resources cover various topics such as budgeting, saving, investing, and debt management, empowering you to make informed decisions about your finances. By participating in these workshops, you can gain valuable insights and practical tips that will benefit your financial well-being in the long run.

To complement the financial literacy resources available, the UOB EVOL Card also organises workshops and seminars conducted by experts in the field of personal finance. These sessions not only provide you with in-depth knowledge but also offer practical tools and strategies that you can implement in your own financial planning. By taking advantage of these educational opportunities, you can equip yourself with the necessary skills to navigate the complexities of the financial world with confidence.

The Future Of Personal Finance – UOB EVOL Card’s Financial Management Tools

The UOB EVOL Card presents a revolutionary approach to managing your finances. By incorporating cutting-edge technology and user-friendly interfaces, this card empowers you to take control of your financial well-being like never before. With features such as expense categorisation, budget tracking, and spending analysis, you can now easily monitor your financial habits and make informed decisions to achieve your financial goals.

Imagine being able to visualise your spending patterns at a glance, effortlessly identifying areas where you can cut back or save more. With the UOB EVOL Card’s comprehensive financial management tools, you have the power to optimise your financial health and build a more secure future. By leveraging the insights provided by this innovative card, you can make smarter choices that align with your long-term financial objectives.

In a rapidly evolving financial landscape, having access to advanced tools like those offered by the UOB EVOL Card is vital for staying ahead of the curve. By embracing the future of personal finance with this groundbreaking card, you are equipping yourself with the resources needed to navigate the complexities of modern money management. So why wait? Take charge of your financial destiny today with the UOB EVOL Card and initiate on a journey towards a brighter and more prosperous tomorrow.

FAQ

Q: What are the key features of UOB EVOL Card’s financial management tools?

A: The UOB EVOL Card comes equipped with features such as expense tracking, budgeting tools, and insights into your spending habits.

Q: How can the expense tracking feature help me manage my finances better?

A: The expense tracking feature allows you to categorise your expenses, monitor where your money is going, and identify areas where you can cut back.

Q: Can I set budget limits using the UOB EVOL Card’s financial management tools?

A: Yes, you can set budget limits for different categories such as dining, shopping, or groceries, helping you stay within your financial goals.

Q: How does the UOB EVOL Card provide insights into my spending habits?

A: The card analyses your spending patterns, highlights trends, and offers suggestions on how you can make smarter financial decisions based on your habits.

Q: Are the financial management tools of the UOB EVOL Card user-friendly?

A: Yes, the tools are designed to be user-friendly, with easy navigation and a clear interface to help you manage your finances effectively and efficiently.